Yesterday, Fortive held its Virtual Analyst Day, providing us with a summary of their performance in the last 5 years, and their plan for the upcoming 5. Overall it was pretty positive, and we continue to think this stock should outperform its peers. Recent M&A activity has made its core business performance a bit more difficult to assess, followed by the pandemic, but as we move forward post divestments, we should get a better picture of the quality of its various underlying bsuinesses.

How has Fortive evolved in the last 5 years. Here their next 5 years plan:

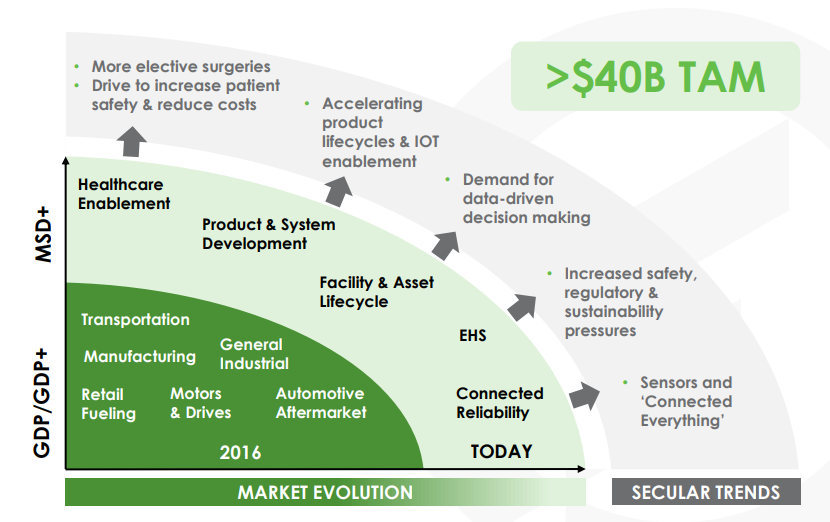

- Revenue growth went from GDP/GDP+ to mid-single digits, with MSD growth rate for next 5 years

- Recurring revenue from 18% to 38% (and next 5 year target of 45-50%), and software from minimal to 13% of sales (to reach 20% in 5 years)

- Gross margin went from 49% to 58% (and next 5 years target to reach 60%)

- EBITDA from 23% to 24% (and next 5 years target in high 20s)

- FCF guidance for 2021 of $970M to reach over $1.6B in 5 years

Three key areas of focus for their Fortive Business System (FBS) – a toolbox set in place to seek outperformance:

- Innovation: partnered with Pioneer Square Labs to nurture start-ups that will ultimately be part of FTV’s portfolio. >$2B in market opportunities have been discovered via these innovation initiatives

- Software: to improve business processes, and drive dollar retention. SO far they have seen 400bps in net dollar retention.

- Data analytics: identified $250M in projects in 2020, driving the next generation of products.

How good is Fortive at integrating acquired businesses? Here’s the example of ASP, acquired from JNJ:

FTV had to create their critical business infrastructure, including HR systems, CRM systems, legal entities and transferring business licenses. 10,000 customer contracts were converted, 77 logistics hubs were reduced to 28 (and keeping deliveries on time). The integration process was planned to take 24 months but was done in 10. The customer installed base had been declining prior to acquisition, and is now on track to expand by 6pts between end 2019-end 2021.

Segment review:

Advanced Healthcare Solutions: The company in 2021 is expected to see $1.2B in revenue, gross margin of mid-50%, EBIT margin of low-20%, and market size of $10B and growth of mid-single-digits

Changes made in this segment since 2016:

- Total addressable market grew from $1.1B to $10B

- Revenue grew from $170M to $1.2B

- Recurring revenue from less than 5% to 70%

- Operating margin from 20% to mid-20%

Precision Technologies: expect 2021 revenue to reach $1.8B, gross margin in the low 50%, EBIT margin 21-22%, market size of $14B with growth of LSD.

Macro drivers:

- Internet-of-things

- Growth in wired and wireless communications

- Need for higher power density given electrification and sustainability push

Intelligent Operating Solutions:

2021 guidance: $2.1B revenue ($1.2B in 2016), 66% gross margin, 27-28% EBIT margin, $19B addressable market (%7B in 2016), growing in the mid-single-digits.

Secular drivers:

- an ageing technician workforce

- increasing penetration for software-enabled solutions

- connectedness through the proliferation of sensors

- risk/sustainability management complexity

- competition driving need for productivity improvements

- explosion of data.

The theme of sustainability was one of the main pillars of their annual investor presentation, a trend that has accelerated most in the last 18 months than in the past 2 decades.

Their 5 pillars are:

- Empower an inclusive and diverse team

- Invest in communities served

- Protect the planet

- Work and source responsibly

- Operate with principle

FTV increased its goal of reducing scope 1 and scope 2 carbon emissions by 50% 2025 (vs. 40% by 2030).

Similar to Crestwood, FTV is working on increasing its diversity, inclusion and equity.

A snapshot of Fortive’s portfolio:

How do they look at their Total Addressable Market (TAM):

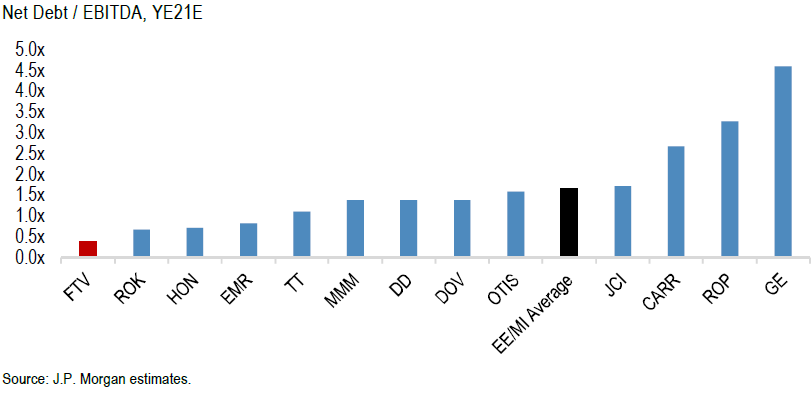

Regarding the balance sheet, Fortive has the lowest leverage vs. peers:

FTV Thesis:

- Market leader:

- Leadership position in most of the markets they serve

- Experienced leadership team

- Above industry margins with strong cash flows

- Quality:

- FCF yield ~5%

- Organic growth target of 3-3.5% (4-5% in last 2 quarters after being under the target in prior quarters)

- M&A strategy to enhance top line growth

- Margins expansion from new products introduction, continued application of the Fortive Business Systems and M&A integration

- Shareholder friendly:

- Management team focused on shareholder wealth creation through top line sustainability and margin expansion

$

FTV.US

Category: earnings

Tag: FTV

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109