Key Takeaways:

Current price: $79 Price target: $94 (under review)

Position size: 1.39% 1 year performance: +4%

THE INVESTMENT THESIS IS UNDER REVIEW – DO NOT ADD TO PORTFOLIOS

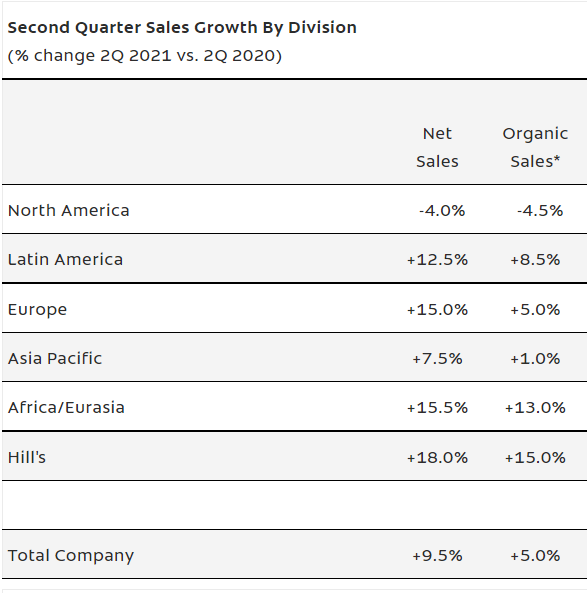

Colgate released its 2Q2021 earnings this morning. Results for the quarter were in-line with expectations, but the company lowered full-year profit guidance due to cost pressure, which is driving the stock lower today. Reported sales were up 9.5%, with every regions expect North America in positive territory, and despite tough comps from consumer pantry loading last year. Adjusted EPS was up 8%, lower than sales as gross margin declined 80bps due to higher costs (raw materials and transportation). The company expects easing material costs in 2022. Free cash flow for 1H21 is 40% below 1H20 and 10% below 1H19, as cash flow from operations is lower while capex is increasing to fund future projects. While we understand the cost pressure companies are facing in 2021, we think a market share leader such as Colgate should be able to weather this better in our eyes.

- Total organic sales were +5%, and details by region is listed below. Overall pricing was +2.5% and volume +2.5%

- North America sales decline is mostly due to lower volume y/y in the US in personal and home care. This was due to logistics issues and promotional abilities in the market

- Operating profits: the decline is due to significant higher raw material costs, higher logistics costs and increased advertising expenses, partially offset by some pricing increase

- 2021 guidance reiterated:

- Organic sales to be 3-5% (in line with its long term target), reported sales +4-7%

- Gross margin now expected to decline (previously expected expansion), and increased advertising spending

- EPS growth now expected at the lower end of its mid-single to high-single digits growth

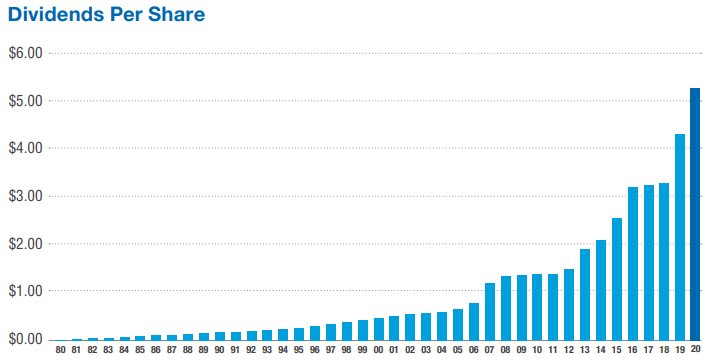

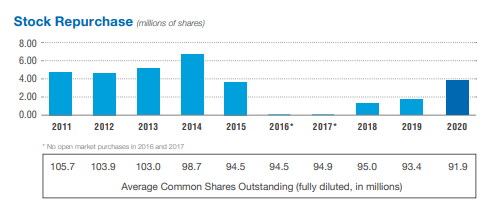

- Capital allocation plans: dividend, debt paydown and share repurchase increased. They see some strategic gaps they want to fill in their portfolio with M&A

- Earnings call quote:

- “We are also dealing with the impact of COVID, restrictions in several markets, economic and political uncertainty, strong competitive activity. And of course, significantly heightened raw material and logistics headwind . We expect that all of these factors will continue to impact our business”

- Latam comments: “So obviously the market seems to be returning despite the fact that would definitely not out of the woods relative to COVID”

The Thesis on Colgate

- High exposure to fast growing emerging markets (36% of Operating Profit from Latin America; 50%+ from EM)

- Defensive Product set (soap and toothpaste). Product line less vulnerable to trade downs due to low private label exposure in the categories

- Strong balance sheet (net debt/ebitda 1.4x) and highest ROIC in the sector

- 2.64% dividend yield

$CL.US [tag CL] [category earnings]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109