Key Takeaways:

Current Price: $87.9 Price Target: $102

Position size: 2.24% 1-Year Performance: -3%

- Sales growth of 11% was above expectations, driven by the Flavor segment recovery and acquisitions

- Consumer segment sales -2% (organic growth down 7% y/y). Household penetration continues and market share gains in various regions. Acquisitions add 2%

- Flavor Solutions +40%% y/y (+25.5% organic), as foodservices and restaurants returning to growth post-pandemic

- Capacity constraints

- Gross margin declined 190bps as sales shift between segments towards lower margin Flavor segment – but up 40bps vs. 2019 level

- Cost inflation not fully offset by price increase

- Operating margin down 200bps vs last year but up 10bps vs. 2019

- FY2021 guidance

- Organic revenue growth now 8-10% from 6-8%

- Cost inflation on commodities, packaging and freight is worse, in the mid-single digits rate

- Raising prices this year to cover costs, but lagging

- Tough comps ahead for top line in 3Q

- Raising EPS guidance to $3.00-$3.05 from $2.97-$3.02 thanks to better revenue outlook

- Valuation is on the higher end on a P/E and FCF yield but MKC is a solid performer year over year and provide good growth and M&A strategy. Long-term thesis is intact.

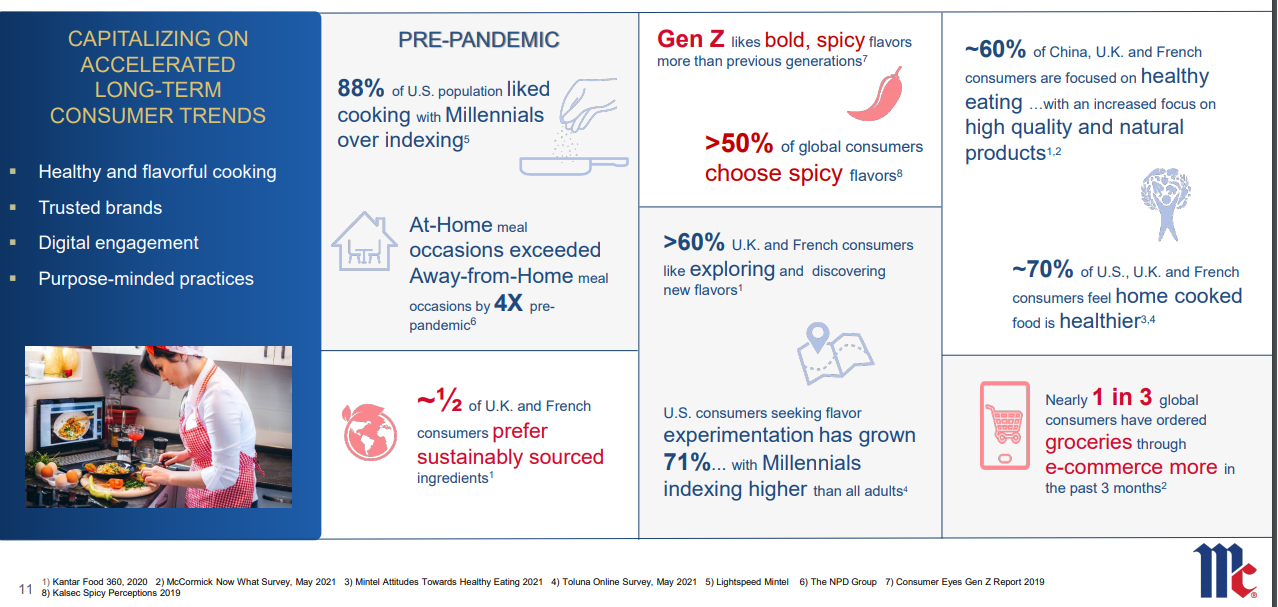

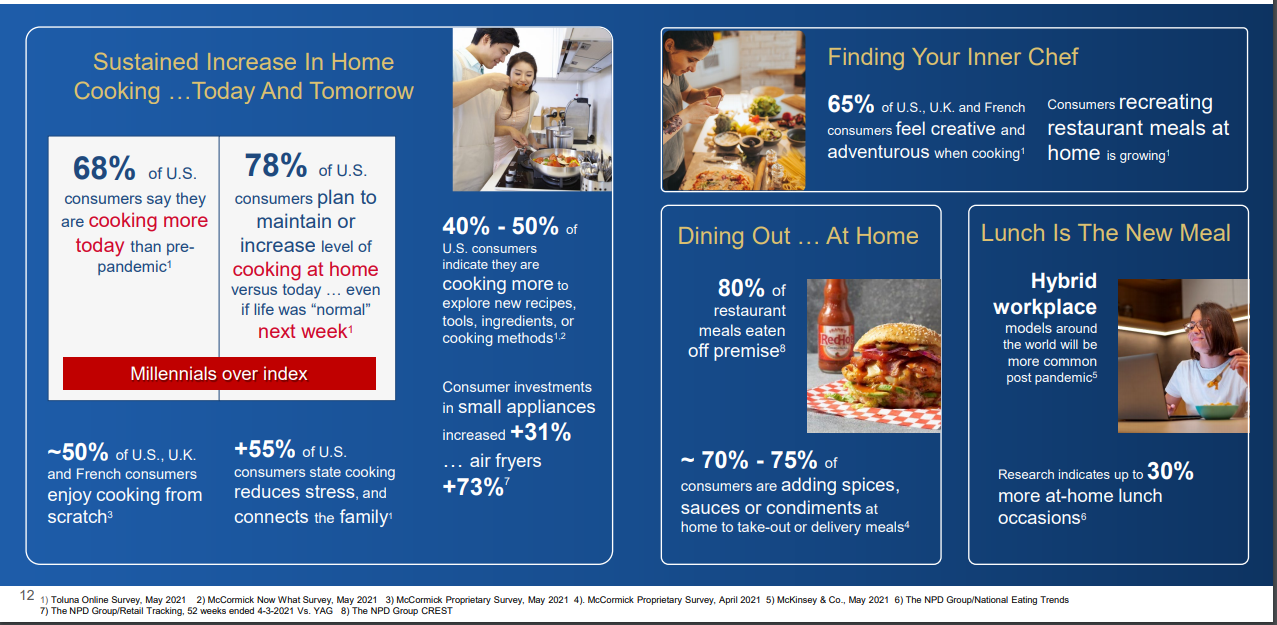

The company provided these data points on consumer behavior around cooking/eating pre and post-pandemic – which highlight the continued secular growth patterns supportive of MKC’s portfolio of brands:

The Thesis on MKC:

- Industry Leader: McCormick & Company (MKC) is a leading manufacturer of spices and flavorings. MKC has been in business for 120 years and the founding family still has ownership interest

- Growth opportunity: Spice consumption is growing 3 times faster than population growth. With the leading branded and private label position, MKC stands to be the biggest beneficiary of this global trend

- Offense/Defense: MKC supplies spices to major food companies including PepsiCo and YUM! Brands giving it a blend of cyclical and counter-cyclical exposure

- Balance sheet and cash flow strength offer opportunities for continued consolidation through M&A in the sector

$US.MKC

[tag MKC]

[category earnings]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109