On 7/16, Bank of America (BAC) reported core Q1 EPS of $.84 ahead of estimates of $.77. Highlights for the quarter were continued deposit growth, strong credit metrics and balance sheet quality. Concerns were negative loan growth as low rates encouraged refinancing of residential mortgages. BAC’s earnings are levered to rising rates, providing ballast to the portfolio. We expect the announced dividend increase (+17%) and share buybacks to support stock price.

Current Price: $38.5 Price Target: $40

Position Size: 2.24% Trailing 12-month Performance: 61.7%

Highlights:

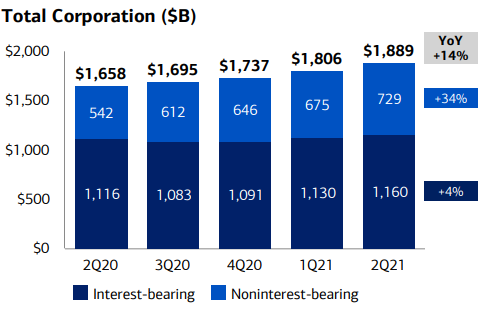

- Deposits surged 20% YOY spurring growth in equity of 3.0% YOY

- Strong metrics for loan quality throughout pandemic. This quarter BAC released $1.6b in loan loss reserves.

- Over $31b of excess capital – announce 17% increase in dividend with last quarter’s announcement of $25b share buyback which is worth 7.5% of outstanding shares.

Concerns:

- Expenses remain higher than pre-pandemic levels. During quarter BAC donated $500m to Charitable Foundation, elevating expenses.

- Negative loan growth. Low interest rates have sparked a wave of mortgage refinancings. Despite BAC issuing new loans, there existing loan book has been shrinking. This trend seems to have bottomed.

- Net Interest Margin (NIM) fell to 1.83% from 1.90%

- Deposits have grown 14% YOY

- BAC ranked #1 in deposit share

- Fiscal stimulus programs have supported consumers

- BAC pays just .03% on deposits

- BAC has managed the pandemic well with strong credit performance.

- Net charge-offs only 0.27% of loans. Last year this ratio peaked at 0.45%. For comparison during 2010, the charge-off ratio peaked at 3.8% showing the relative severity of the Great Recession and the current strength of the U.S. banking system.

- With improving economy and outlook, BAC released $1.6b from loss reserves

- Excess capital

- Last quarter, BAC announce a $25b share repurchase program which is worth 7.5% of outstanding shares.

- Increased dividend by 17% expected yield is 2.2% for a shareholder yield over 9%.

BAC Thesis:

- Over the years BAC has dramatically improved their Consumer Banking unit, leveraging technology and their digital platforms which has driven earning’s growth.

- BAC has a high-quality loan book which was seen during the pandemic as loan loss metrics were best among peers

- BAC has strong earnings power, generating over $5b a quarter in earnings

- BAC continues to build capital which should lead to increased dividends and buybacks

- BAC’s earnings are sensitive to rate increases. They estimate a 100 bps parallel shift in the yield curve will increase income by $8b or $.90 in EPS.

Please let me know if you have questions.

Thanks,

John

[category Equity Earnings]

[tag BAC]

$BAC.US

John R. Ingram CFA

Chief Investment Officer

Partner

Direct: 617.226.0021

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109