DoubleLine Total Return Bond Fund Commentary – Q2 2021

Thesis

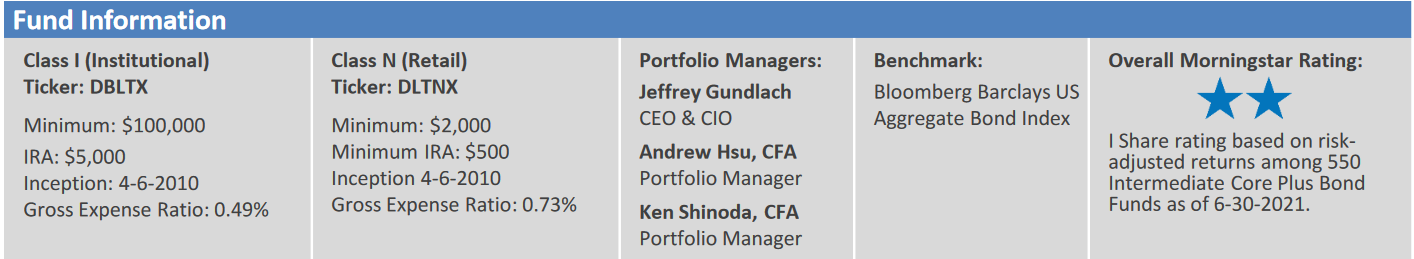

DBLTX (currently yielding 3.13%) utilizes a top down-bottom up process that focuses on MBS and Agency bonds. When compared to the benchmark (Barclays U.S. AGG), the holdings have lower duration and exposure to corporate bonds, reducing their sensitivity to interest rate movements and credit spreads. We expect attractive risk-adjusted return characteristics over the long term from DBLTX, especially during periods when corporate bonds’ spread increase and the yield curve steepens.

[more]

Overview

In the second quarter of 2021, DBLTX underperformed the benchmark (Barclays U.S. AGG) by 24bps, largely due to two factors: duration positioning and asset allocation. The fund’s lower duration than the index, especially in the corporate bonds and U.S. Treasury space detracted from returns. All sectors in the fund generated positive returns, with non-agency CMBS contributing most to overall performance. Agency residential MBS also contributed to performance.

Q2 2021 Summary

- DBLTX returned 1.59%, while the U.S. AGG returned 1.83%

- Quarter-end effective duration for DBLTX was 4.22 and 6.58 for the U.S. AGG

- The top two performers were non-Agency CMBS and Agency residential MBS

- Increase in travel and leisure activity in the U.S. as well as duration-related price increases

Outlook

- We continue to hold this fund due to the approach and strong diversification factor within our core bond holdings

- DBLTX is a good position to hold due to its low duration which outperforms during periods of rising rates – Treasury yields were at all-time lows in 2020, increased during Q1 2021, but dropped again in Q2 2021

- Historically, DBLTX has displayed stronger returns and lower volatility than the index

- DBLTX has had consistent strategy, allocation focus, and sector distribution

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109