Eaton Vance Floating-Rate Fund Commentary – Q2 2021

Thesis

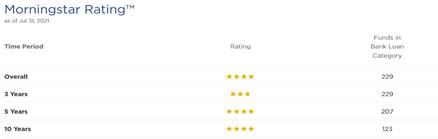

EIBLX (currently yielding 3.15%) is a large floating rate fund that has a strong historical returns and a tenured management team. By investing purely in senior bank loans, EIBLX further increases our potential upside gain, reduces our duration-risk, and decreases our interest rate risk. We like that the fund utilizes a bottom-up investment process through proprietary framework analysis, avoids high-yield corporate bonds, and allocates to relatively higher-rated securities within the floating rate security space.

[more]

Overview

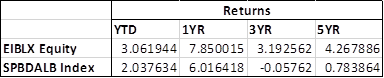

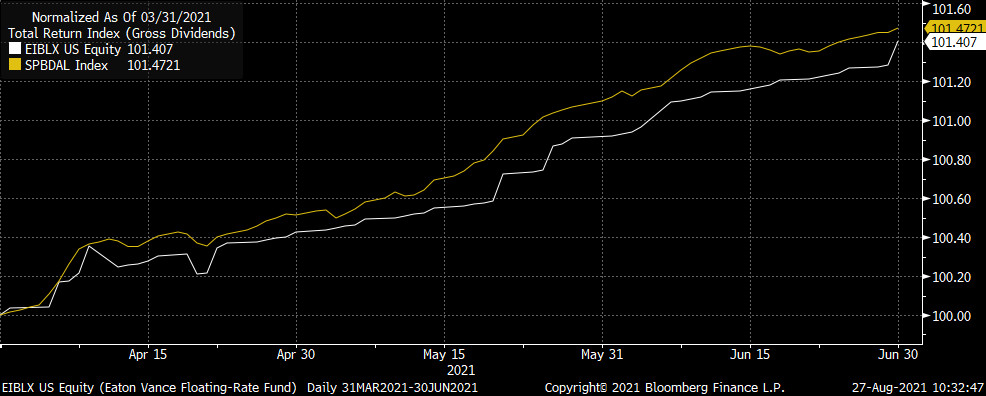

In the second quarter of 2021, EIBLX performed roughly in line with the benchmark (S&P/LSTA Leveraged Loan Index). The fund’s credit positions in radio and television companies and glassware maker contributed to return. An underweight to the utilities sector benefited performance, as did a modest allocation to CLOs. On the other hand, an allocation to cash and oil and gas holdings detracted from overall performance. The fund’s bias towards higher-quality also acted as a headwind as CCC-rate and second-lien loans performed well during the quarter – two areas that the fund is underweight.

Q2 2021 Summary

- EIBLX returned 1.41%, while the Leveraged Loan Index returned 1.47%

- Quarter-end effective duration for EIBLX was 0.34 and 0.11 for the Leveraged Loan Index

- Three largest contributors

- Overweight to iHeartCommunications, Inc., Alliance Healthcare Svcs, and Cumulus Media New Holdings Inc.

- Three largest detractors

- Overweight to Samson Investment Co, Cash, and Ameriforge Group Inc

Optimistic Outlook

- We hold this fund due to its relatively high yield and shorter duration, especially as we believe that rates will increase in the coming years

- Massive stimulus, an accommodative set of monetary policies, and continued rollout of vaccines provide a positive backdrop for the asset class

- Default rates continue to decline giving a favorable outlook, yet loan valuations look to be fairly and fully priced

- Assuming no defaults in July, the default rate could drop to 0.58% (lowest rate since April 2012)

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109