Fidelity Advisor Floating Rate Fund Commentary – Q2 2021

Thesis

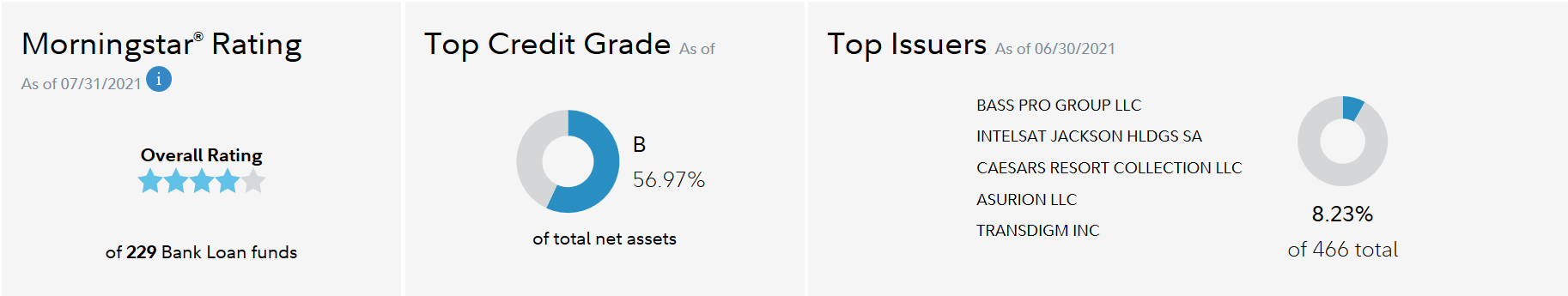

FIQSX (currently yielding 3.24%) is a large floating rate fund that has a strong historical returns and a tenured management team. By investing purely in senior bank loans, FIQSX further increases our potential upside gain, reduces our duration-risk, and decreases our interest rate risk. We like that the fund utilizes a bottom-up investment process through proprietary framework analysis, avoids high-yield corporate bonds, and allocates to relatively higher-rated securities within the floating rate security space.

[more]

Overview

In the second quarter of 2021, FIQSX performed roughly in line with the benchmark (S&P/LSTA Leveraged Loan Index). The fund’s core bank loan portfolio slightly lagged the benchmark, however exposure to stocks of loan issuers (this is due to restructurings and negotiations) helped keep the fund in line with the index. Security selection in oil & gas was the largest contributor to returns. In general, the asset class trailed high-yield bonds and investment-grade credit. There was a rally in April, though, due to favorable sentiment towards risk assets. The month of May also saw positive returns compared to its peers as vaccination campaigning advanced, while June saw positive (but lagged its peers) returns due to inflation concerns and heavy capital market activity.

Q2 2021 Summary

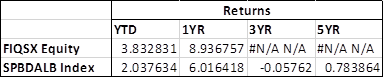

- FIQSX returned 1.52%, while the Leveraged Loan Index returned 1.54%

- Quarter-end effective duration for FIQSX was 0.14 and 0.11 for the Leveraged Loan Index

- Largest contributors were all oil & gas exploration & production companies (equity stake)

- Denbury, California Resources, Chesapeake Energy

- Largest detractors

- Limetree Bay Terminals – out-of-benchmark exposure to oil storage terminal

- Sinclair Broadcast Group – overweight in TV broadcaster

Optimistic Outlook

- We hold this fund due to its relatively high yield and shorter duration, especially as we believe that rates will increase in the coming years

- Positive outlook as vaccinations continue to roll out, government stimulus continues, and the U.S. economy recovers

- New developments around COVID, commodity volatility, and policy missteps by global central banks all pose risks

- The team will continue to search for opportunities in the loan space, even as BB and B-rated securities have approached par

- Finding opportunities in new issue over the secondary market

- Default expectations (now at 1.43%) have greatly improved (down 1.72% from a year ago)

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109