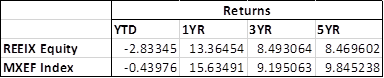

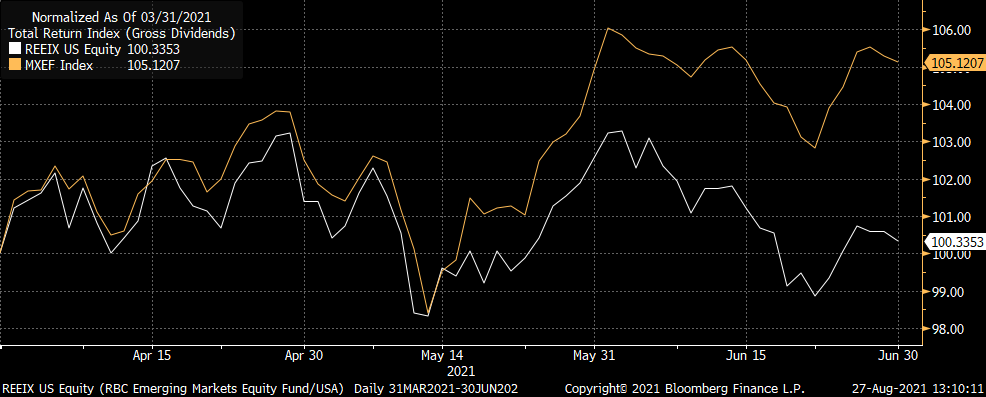

RBC Emerging Market Equity Fund Commentary – Q2 2021

Thesis

REEIX is driven through both top-down and bottom-up fundamental research that provides diversification within our full EM allocation. The fund looks for high quality companies across all market caps that have strong ESG scores. We like REEIX because of the consistent and repeatable process that allows the team to take advantage of companies with sustainable growth across all the Emerging Market (EM) landscape.

[more]

Overview

In the second quarter of 2021, REEIX outperformed the benchmark (MSCI Emerging Markets Index) by 625bps largely due to weak stock selection within the Financials sector. Selection effect in India and South Africa also weighed on returns for the quarter. Selection in Information Technology and Consumer Discretionary on the other hand helped offset some of these negative returns, as did an underweight allocation and strong stock selection in China. In general, riskier companies with lower valuations outperformed, and political disrupt in Latin America and other EM regions caused the asset class to display overall weak performance. China’s large-cap technology companies also took a hit during the quarter which greatly impact the asset class.

Q2 2021 Summary

- REEIX returned -1.20%, while the MSCI Emerging Markets Index returned 5.05%

- Contributors

- Taiwan Semiconductor Manufacturing, Sunny Optical, MediaTek, Tata Consultancy, and Yum China

- Detractors

- Ping An Insurance, Credicorp, NCSoft, Discovery, and B3 SA

Outlook

- We continue to hold this fund and believe in our thesis due to the fund’s historically strong returns and understanding of Emerging Markets on both a macro and micro level

- Fund continues to invest in high-quality companies

- Strong competitive positions, talented management teams, healthy balance sheets, and consistent cash flows

- Looking to take advantage of expanding areas in the economy

- Health and wellness, digitalization, “green” infrastructure, increase access to banking services

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109