Applied Finance Select Fund Commentary – Q2 2021

Thesis

AFVZX serves as our active manager in the large cap “value” U.S. equity markets and follows a concentrated (50 companies) investment strategy that focuses on firm quality and valuation. By utilizing DCF models, bottom-up fundamentals, and holding sector weights that are equivalent to their benchmark (S&P 500 Index), the fund generates alpha over time purely through stock selection. We continue to hold AFVZX because of the team’s ability to compare stocks across all sectors which enables them to generate strong returns over the long run.

[more]

Overview

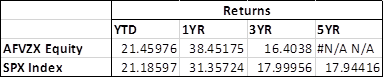

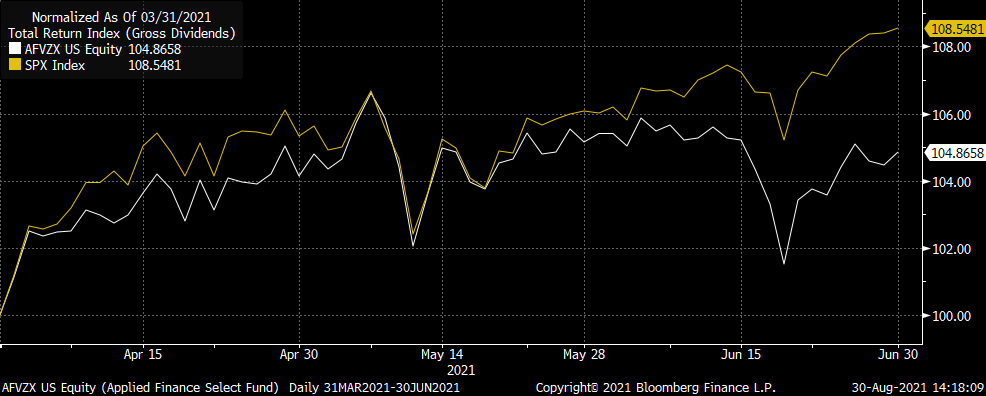

In the second quarter of 2021, AFVZX underperformed the benchmark (S&P 500 Index) by 335bps largely due to selection in Information Technology, Communication Services, and REITs. Within Information Technology, the mega-cap growth stocks started to take over which was a reversal compared to the more value-based Information Technology that performed well in Q1 2021. Offsetting these poor performing sectors were Consumer Discretionary and Healthcare, which contributed to performance.

Q2 2021 Summary

- AFVZX returned 5.20%, while the S&P 500 Index returned 8.55%

- Top contributors

- Consumer Discretionary – TGT, LKQ, and APTV

- Healthcare – DHR and ALXN

- Top detractors

- Information Technology– INTC, FISV, HPQ, and KLAC

- Communication Services – DIS and VZ

- Industrials – ALK and CMI

- REITs – HST

- The fund replaced ALXN with REGN on 06.21.21

- ALXN has agreed to be acquired by AZN

Optimistic Outlook

- We continue to hold this fund and believe in our thesis due to the fund’s ability to outperform the index over the long run through strong stock selection and maintaining a quality and value investment tilt

- See inflation spilling over to future years, allowing higher level to be a bit more sustainable

- Continue to invest in companies with attractive valuation, credible management team, and a strong wealth creation track record and strategy

- Believe the fund’s holdings will continue to navigate the market well and positioned to perform strongly as the economy continues to reopen

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109