Lazard International Strategic Equity Fund Commentary – Q2 2021

Thesis

LISIX is a bottom-up, growth-based fund that completes the core satellite strategy within global equity. The fund is unique in that it focuses on individual stocks rather than markets and looks for reasonably priced companies with strong growth potential. We like LISIX because of the managers’ expertise in various market caps, geographies, and sectors which helps keep the fund diversified while providing strong upside and downside capture over time.

[more]

Overview

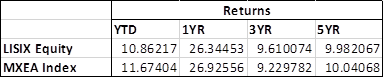

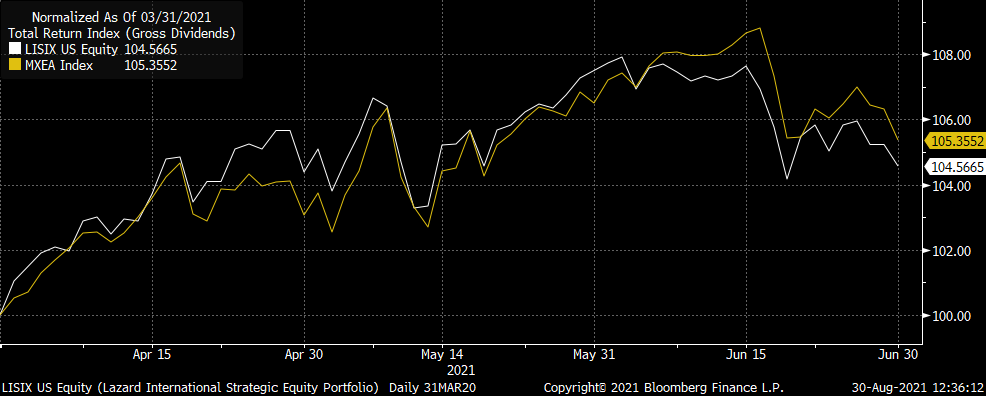

In the second quarter of 2021, LISIX underperformed the benchmark (MSCI EFEA Index) by 60bps due to the high returns of low-quality stocks that the fund does not have exposure to. More specifically, the allocation effect, lack of exposure to expensive stocks, and short-term performance challenges related to stock selection negatively weighed on returns. The fund also saw a handful of buys including Adidas AG, Asics, Daikin Industries, Industria de Diseno Textil S.A., MTU Aero Engines AG, and Shimano. It also sold out of BHP, Canadian National Railway, EDP Portugal, Flughafen Zurich, Hexagon, Nintendo, Ping An Insurance, Safran, and Z Holdings. Focusing on fundamentals and valuation the fund is expecting investors to do the same, thus seeing strong a move away from emotion driven investment decisions.

Q2 2021 Summary

- LISIX returned 4.57%, while the MSCI EAFE Index returned 5.17%

- Positives

- ABB – beneficiary of secular trends in electrification and automation, and reopening economies around the world

- Carlsberg – a compounder with strong capital allocation framework

- Negatives

- Vestas – high-quality company that acted as a headwind due to a rotation our of secular energy companies and into cyclical energy companies

- Nexon – a video game producer that lagged due to a cyclical rally and a weak outlook during earnings

Outlook

- We continue to hold this fund and believe in our thesis due to the fund’s strong stock selection, ability to find well valued companies, and expertise in various market caps, geographies, and sectors

- Preference for expensive growth stocks is short-term and is expected to fade going forward

- Inflation will act as a headwind for these types of stocks

- Europe’s recovery will be delayed, but will follow the U.S. once vaccinations pick up in a similar manner to the U.S.

- Same for Japan

- Low-quality value rally will come to an end as massive stimulus programs stop

- Fundamental-driven decision making will come back into favor across investors, causing sharp, emotion-based swings to halt

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109