Current Price: $2,923 Price Target: $3,450 (raised from $3,100)

Position Size: 4.8% TTM Performance:+93%

Key Takeaways:

- Broad beat – gross revenues were $65.1B up 41%

- Continued meaningful op leverage despite resumption of spending on headcount – OM expanded sequentially for the 5th quarter in a row. Now at 39% on net rev, well ahead of high 20’s pre-pandemic.

- Digital ad spending continues to surge – saw broad-based strength in advertiser spend, particularly w/ retailers

- Cloud strength continues – was +45% w/ losses narrowing

- Capex spending resuming – continuing to pick up the pace of investment in office facilities and data centers… “We continue to increase the pace of investment in fit-outs and ground-up construction of office facilities to accommodate our ongoing headcount growth globally. We will continue to pursue real estate acquisition opportunities where it makes sense.”

Similar to last earnings call, there was a big focus on Retail/e-commerce…

- “as the world begins to reopen, shoppers are returning to stores. Brick and mortar isn’t dead – instead, omnichannel is in full force. Searches for ‘open now near me’ are up four times globally vs. last year.”

- Omnichannel and next-gen user experiences are core to their shopping strategy, including:

- Easier ways for businesses to show the local services they offer across Search and Maps.

- Local inventory ads that highlights which products are in-stock and when to pick them up.

- Free shipping and easy return annotations across Search and Shopping.

- AR capabilities that bring in-store moments online and let users try before they buy.

- Instantly shoppable images with Google Lens.

- New visual, browsable experience on Search.

- ” There’s a lot more to come…including tapping into commerce on YouTube“. They are still in the early innings w/ e-commerce potential w/ YouTube. Possibilities include: shoppable livestream events w/ large retailers or letting viewers buy directly from their favorite creators’ videos.

Heavy focus on AI capabilities on the call which is relevant across segments

Google is faring better than others from Apple’s app tracking changes…

- Earlier this year, w/ the latest iOS release, Apple changed their app tracking policies, referred to as ATT (app tracking transparency)…now users need to opt in rather than opt out. This small change has made a very big difference in the digital ad space.

- Google indicated only a “modest impact” to YouTube while Facebook and Snap have both indicated this as a significant headwind for their business.

“Search & Other” revenue: $38B, up 44%

- Seeing broad-based strength in advertiser spend across industries, but some unevenness still across geographies depending on local regulations and vaccines.

- Retail was gain by far the largest contributor to the YoY growth of their Ads business.

- Media & entertainment, Finance and Travel were also strong contributors.

YouTube ad sales: $7.2B, up +43% YoY

- Over 120 million people watch YouTube on TVs every month; that’s up from ~100 million last year

- Strong value proposition to advertisers & positioned to capture the shift in advertising away from linear TV

- “YouTube’s reach is becoming increasingly incremental to TV”

- YouTube helps advertisers reach audiences they can’t reach anywhere else (especially younger audiences) and helping brands do it more efficiently

- Nielsen found that US advertisers who shifted just 20% of spend from TV to YouTube generated a 25% increase to the total campaign reach within their target audience while lowering the cost per reach point by almost 20%.

Network ad revenues: $8B, up 40%. This is revenue from ads placed on sites other than their own, like an ad placed on the NYT site.

Google cloud = Google Cloud Platform (“GCP”) + Google Workspace (i.e. collaboration tools):

- Revenue grew 45% YoY to $5B w/ an operating loss of $644m

- GCP’s revenue growth was again above Cloud overall, reflecting significant growth in both infrastructure and platform services.

Other Bets

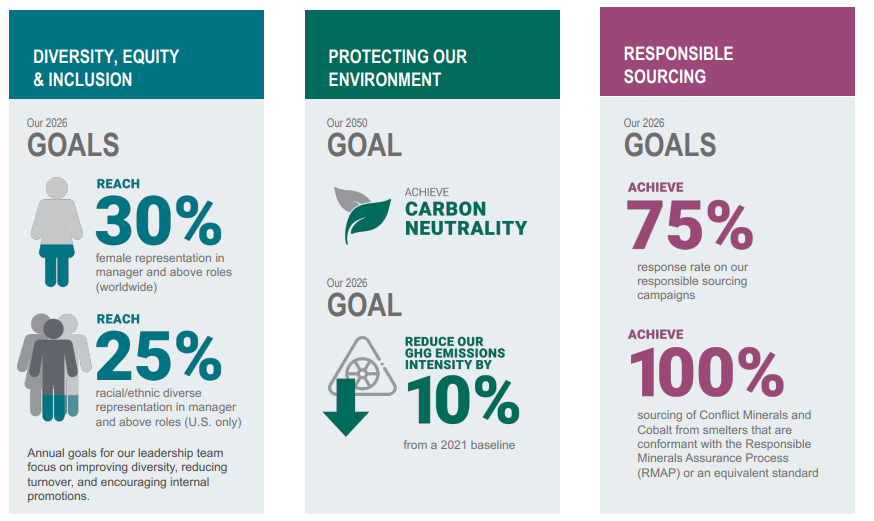

ESG:

- They aim to operate on 24-7 carbon free energy by 2030

- 2/3 of the electricity consumed by Google data centers in 2020 was matched with local, carbon-free sources on an hourly basis

- New Carbon Footprint tool gives customers carbon emissions insights associated with their Google Cloud Platform usage

Valuation – They generated $59B in FCF in the last 12 mos. and ended the quarter with $114B in net cash, ~6% of their market cap. The stock is still reasonably valued, trading at a >4% FCF yield on 2022 and they‘ve been stepping up their pace of buybacks.

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

www.crestwoodadvisors.com