Key takeaways:

Current Price: $164 Price Target: $200

Position size: 2.05% 1-Year Performance: +11%

- 3Q2021 results:

- Overall sales +10% organic, adjusted EPS +16.4%

- Pharma segment performing well with sales +13% organically, higher than last quarter of +11%

- Covid vaccine sales below expectations, but still expect and additional 300bps growth from vaccine sales for the year

- Oncology +16.5% – growth in multiple drugs (Darzalex, Imbruvica)

- Infectious diseases +60% strong growth (covid vaccine added growth vs. last year)

- Immunology +12% growth in Stelara (Crohn’s disease, Tremfya for psoriasis)

- Pulmonary Hypertension +16% – share gains in Opsumit and Uptravi

- Cardiovascular/other only sub-segment negative growth -12% due to biosimilar competition

- Consumer segment: +4% growth

- Growth driven by over-the-counter (OTC) drugs +18%

- Medical Devices: +7% organic sales growth

- Growth driven by market recovery post pandemic, new product introduction success

- Modest impact from covid Delta

- EPS growth driven in part by lower taxes

- Surgical robot Ottava for general surgery is delayed another 2 years … this is a positive for Medtronic that is developing a similar robot.

- Earnings call quote:

- Robot: “a first in-human delay of approximately two years from our earlier projections of the second half of 2022, reflecting technical development challenges and COVID-19 related disruptions, including supply chain constraints being experienced broadly across all industries.”

- Labor shortages: ” When we look at quarter four, we do expect to see continued improvement. We do expect hospitals are going to have to continue to manage through labor shortages, I don’t expect that to get better in quarter four nor in 2022, but they’ve been quite masterful and how to manage patient close.”

- ” We are, when I talk to hospital systems over the past three weeks in particular, in the United States, they are ramping up again and resuming elective procedures.”

- New CEO Joaquin Duato to transition January 2022

- 2021 guidance raised:

- Revenue raised slightly on the lower end due to core sales growth – nothing meaningful though but a positive signs in the wake of the Delta variant

- Tax rate is lowered due to one-time benefits

- EPS increased due to good operational growth and lower tax rate

Thesis on JNJ:

- High quality company with consistent 20% ROE, attractive FCF yield,

- Investments in the pipeline and moderating patent expirations create a profile for accelerated revenue and earnings growth

- Growth opportunity: Medical Devices and Consumer offer sustainable growth and potential for expansion internationally

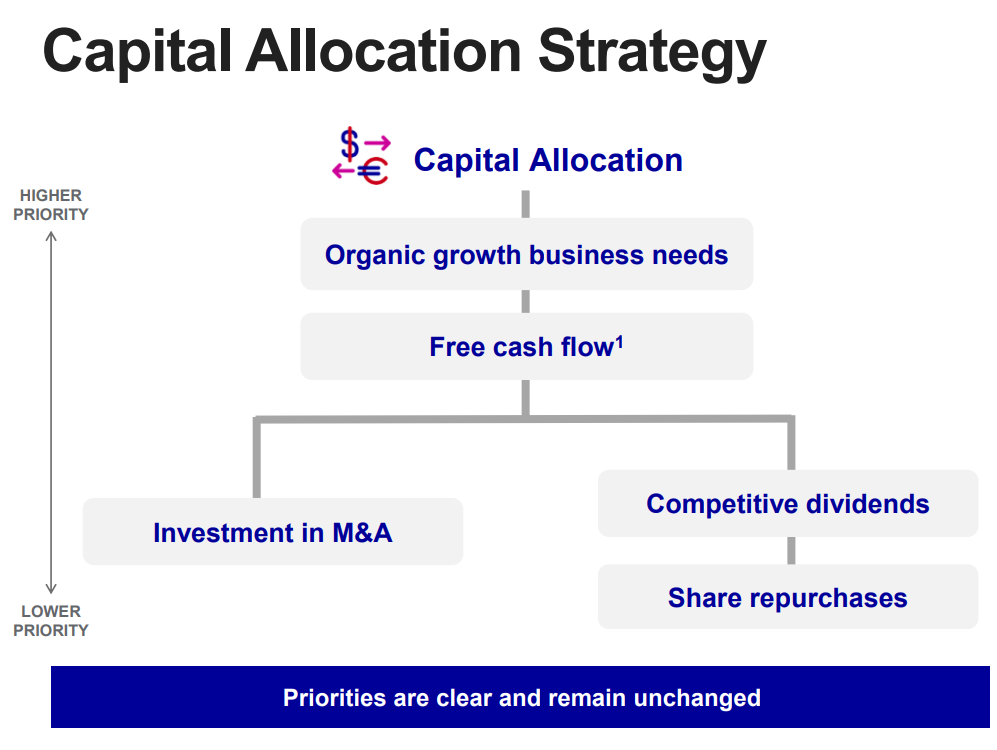

- Strong balance sheet that offers opportunities for M&A.

[category Equity Earnings]

[tag JNJ]

$JNJ.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109