- Strong new asset growth of 8% – $396b YTD, showing strength of Schwab’s platform

- Profitable franchise – pre-tax margin of 44.0% and ROE of 12%

- Earnings are highly levered to short-term interest rates – 25 basis point increase in Feds Funds rate will increase earnings 4%-5% over following 12 months!

Current Price: $83.6 Price Target: $90 (increased from $78)

Position Size: 2.72% Performance TTM: 109%!

Schwab is building scale and platform as a premier asset gather.

- YTD Schwab recorded 5,988k new brokerage accounts in the first half of this year

- Schwab is succeeding with millennials. 60% of new-to-firm households were under the age of 40.

Expenses

- Versus last quarter, total expenses are down -8%.

- Through merger with TD Ameritrade, SCHW expects $1.8b-$2.0b in expense savings over next 3 years, which equates to ~20% of total expenses.

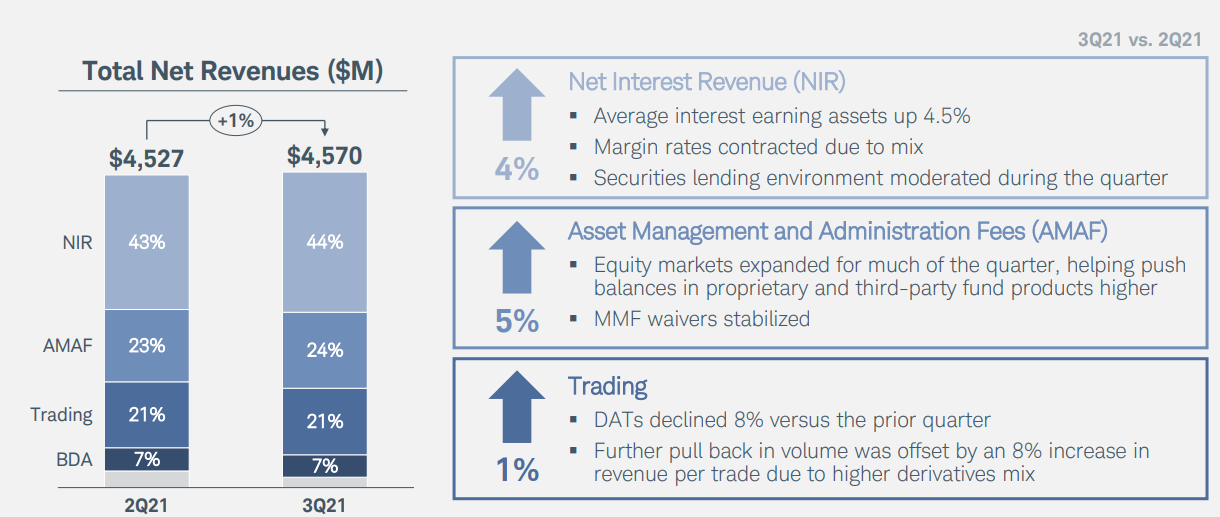

Quarter over Quarter revenue was up +1%

Profitability – industry leader

- ROE of 12% and pre-tax profit margin of 44%. Expect margins to continue to expand over the next 2-3 years due to cost savings and scale from the mergers

- Current expenses are elevated due to mergers

Capital allocation

- Schwab plans to build capital on the balance sheet due to rising deposits and mergers, which may temper share buybacks.

- Dividend yield of 1.05%

Schwab Thesis:

- Expect Schwab’s vertically integrated business model to drive AUM growth. Schwab has averaged 6% organic core net new asset growth as retail clients and advisors are attracted to Schwab’s low-cost trading and custody services.

- Conservative, well-managed firm who is a leader in online trading and focused on leveraging platform.

- Schwab has experience material AUM growth with USAA and TD Ameritrade mergers. Expect SCHW to reduce costs and continue to leverage platform.

Please let me know if you have questions.

Thanks,

John

[category Equity Earnings]

[tag SCHW]

$SCHW.US

John R. Ingram CFA

Chief Investment Officer

Partner

Direct: 617.226.0021

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109