Advising to not buy in new accounts or add money to the position. Will use LMT over time to fund new ideas.

Generally, the slowdown was expected, with the stock’s performance reflecting this (flattish prior to this quarter’s earnings release). What was surprising was the magnitude of the decrease in sales growth projected for 2021-2023, with new programs coming online later in the decade, vs. what we were expecting (a faster timeline of execution). Lockheed has been a solid, consistent performer in the last 10 years. This guidance revision is unexpected, and looks to us like a red flag to the investment thesis.

Current Price: $332 Price Target: $396 (NEW)

Position Size: 2.27% 1-year Performance: -5%

A new price target of $396 is reflecting the lower top line growth and flat margins. While valuation and dividends are somewhat attractive, we think it could take years for this growth to materialize and reflect a below-peers growth story near-term.

Overview of 3Q2021 results:

Results were mixed, with sales below consensus but margins better. The -3% sales decline was mostly due to Missile and Space segments (-6.4% y/y from tactical and strike missiles, sensors and sustainment programs) and Space segment down 5% (due to the AWE program – the UK nuclear program).

Overall margins held well +130bps overall.

Guidance downgrade:

For 2021

- Sales guidance reduced by 1.5% due to Aeronautics sector but margins maintained. Mostly due to supply chain delays.

- Cash flow guidance reduced by 6.7%

For 2022

2022 seems like the reset year for growth going forward. There is about a $1B headwind to 2022 revenue from various parts of the portfolio, driving the 1.5% sales decline:

- Top line reduced due to supply chain delays, and the continuing effects of the ongoing COVID pandemic and extended delivery timelines across our supply chain – worsen towards the end of Q3 2021.

- Moderating growth rates in the U.S. defense budget: LMT guided to lower growth than what the DoD budget is set to grow at, and lower than peers – peers could possibly guide to high?

- Shifts in customer priorities driven by recent events, such as:

- the withdrawal of U.S. forces from Afghanistan ($200M or 0.3% of total 2021 sales)

- the renationalization of the AWE program in the UK (1.2% of total revenue for 2021)

- Program maturity:

- F-35: while the entire program $ remains the same, the delivery timing is pushed to out years, impacting the next couple of years’ sales. What this means is that instead of delivering 170 F-35, the company now targets 156 F-35 for a longer time period (through 2035). In addition, the F-35 sustainment growth was reduced slightly from high single digits announced in September to 6%. 2022 impact from F-35: $400M or 0.6% of 2021 revenue

- Black Hawk: $350M impact from program reaching maturity

- Previously mentioned classified program is still early on and won’t offset decline in other programs quite yet.

Cash flow guidance reduction of 6.7%, and unclear thereafter. Aerojet purchase remains on the table but pushed out to 1Q22 rather than 4Q21.

For 2023-2026:

Slight increase in 2023 with steady growth after – depending on new programs production start. Operating cash flow guidance is not clear, depending on growth program cash needs.

Drivers to growth:

- Performance on current programs

- Sikorsky CH-53K has funding support – should add incremental $300M in 2022

- Space funding support OPIR and GPS

- Ability to win new programs

- Future defense budget

- Global political landscape

Growth areas:

- Hypersonic portfolio – working on 6 programs currently with multiple ones entering production in 2023 and 2026

- Classified activity: production could start in 2023 and 2026

- CH-53K heavy-lift helicopter, F-35 sustainment, PAC-3 increased production, modernization of Fleet Ballistic Missile

Capital allocation update:

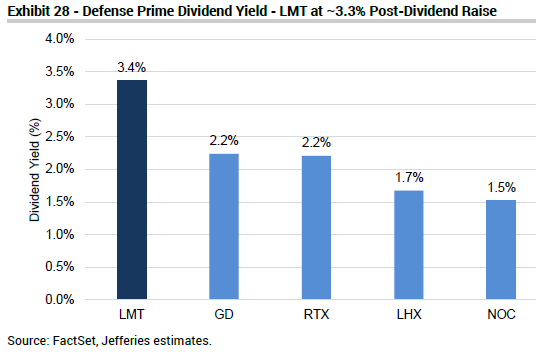

LMT is looking to do a $6B of share repurchase in 2022-2023 (already announced prior to this earnings report). An additional $5B was accepted in Q3, shifting the focus to share repo near term. Capex will go up in 2022 to support the Space segment. Any remaining cash will go towards dividends (+8% just authorized – increasing the yield to 3.4%).

Because LMT has made multiple advance payment in its pension plan, it is not expected to make a required pension cash contribution before 2026 with minimal contributions thereafter.

There is a potential change comping for R&D tax amortization, removing the allowance to write off R&D from a tax perspective. Instead of being able to expense it all in the year it was expensed, it will be amortized over 5 years. This means that in 2022, only 20% of 2022 R&D expenses can be used as a tax shield. For LMT, this represents a $2.2B impact on 2022 FCF.

LMT Thesis:

· Lockheed Martin is a primary beneficiary from the replacement cycle for aging military aircraft and ships

· Excellent management team focused on returning capital to shareholders

· Strong cash flow and financial position

[category earnings] [tag LMT] $LMT.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109