Fidelity Advisor Floating Rate Fund Commentary – Q3 2021

Thesis

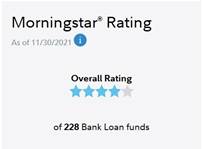

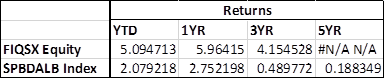

FIQSX (currently yielding 2.98%) is a large floating rate fund that has a strong historical returns and a tenured management team. By investing purely in senior bank loans, FIQSX further increases our potential upside gain, reduces our duration-risk, and decreases our interest rate risk. We like that the fund utilizes a bottom-up investment process through proprietary framework analysis, avoids high-yield corporate bonds, and allocates to relatively higher-rated securities within the floating rate security space.

[more]

Overview

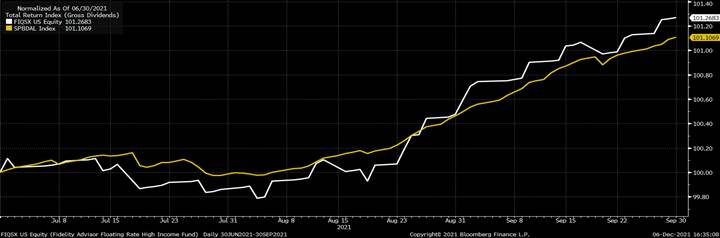

In the third quarter of 2021, FIQSX performed roughly in line with the benchmark (S&P/LSTA Leveraged Loan Index). The fund’s core bank loan portfolio performed roughly in line with the benchmark. Security selection in oil & gas contributed most to returns. In general, loans outpaced high-yield corporate bonds, investment-grade corporate credit, and broad investment-grade fixed income securities. Almost all industries contributed to returns, along with CLOs which continued to be a substantial source of loan demand.

Q3 2021 Summary

- FIQSX returned 1.10%, while the Leveraged Loan Index returned 1.14%

- Quarter-end effective duration for FIQSX was 0.08 and 0.07 for the Leveraged Loan Index

- Largest contributors

- California Resources and Chesapeake Energy (oil & gas equity), Murray Energy (coal mining equity)

- Largest detractors

- Denbury (energy E&P equity), Envision Health (loan business)

Optimistic Outlook

- We hold this fund due to its relatively high yield and shorter duration, especially as we believe that rates will increase in the coming years

- Improvement in leverage loan default rate (down to 0.89%)

- Finding attractive opportunities in new-issue market

- Large overweight in lodging & casinos, retailers, and oil & gas

- Large underweight in health care, electronics/electrical, and automotive

- Continue to hold an overweight to BBB & above and BB rated loans, and underweight to B and CC & below rated loans

- Expecting to see continued GDP, corporate cash flow, and earnings growth

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109