Lazard International Strategic Equity Fund Commentary – Q3 2021

Thesis

LISIX is a bottom-up, growth-based fund that completes the core satellite strategy within global equity. The fund is unique in that it focuses on individual stocks rather than markets and looks for reasonably priced companies with strong growth potential. We like LISIX because of the managers’ expertise in various market caps, geographies, and sectors which helps keep the fund diversified while providing strong upside and downside capture over time.

[more]

Overview

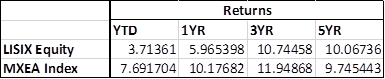

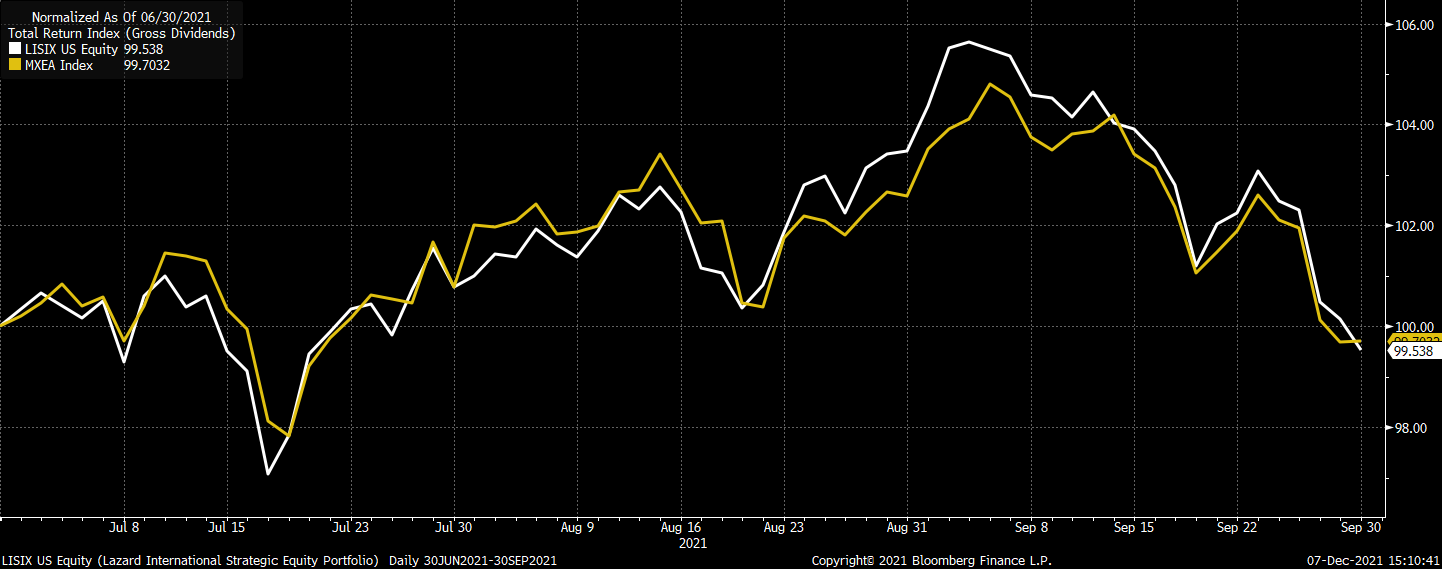

In the third quarter of 2021, LISIX underperformed the benchmark (MSCI EFEA Index) by 14bps due in large part to EM allocation and selection. The fund also held an underweight to the UK and Japan, which outperformed during the quarter. Stock selection on a sector and regional basis contributed to returns, though. In general, the fund managers believe selection will be more important for outperformance compared to the previous quarters, which heavily relied on allocation.

Q3 2021 Summary

- LISIX returned (0.59%), while the MSCI EAFE Index returned (0.45%)

- Positives

- Shimano – a dominant, global bicycle gear manufacturer in Japan

- Aon – global insurance broker in Ireland

- Makita – a leading global supplier of power tools in Japan

- RELX – a UK-based professional publisher

- China Longyuan – an energy and utility company focused around wind farms in China

- Negatives

- Sands China – casino and resort owner/developer in Macau

- Alibaba – the largest e-commerce company in China

- Nexon – a Japanese video game producer

- Enel – Italian utility company

- Banco Bradesco – a bank located in Brazil

Outlook

- We continue to hold this fund and believe in our thesis due to the fund’s strong stock selection, ability to find well valued companies, and expertise in various market caps, geographies, and sectors

- Believe that COVID fears are baked into prices, but concerns around labor shortages, supply chain disruptions, inflation, U.S. tapering, and politics will continue to make a volatile and uncertain market

- See strong growth potential in Europe, especially as vaccines continue to rollout through the region

- Fundamental-driven decision making will come back into favor across investors, causing sharp, emotion-based swings to halt

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109