Key Takeaways: Long-term thesis is intact so I recommend to take advantage of recent weakness and add to SYK in any account that is underweight SYK vs. our model.

Current Price: $239 Price target: $293

Position size: 2.31% 1-year Performance: +6%

Stryker released its 4Q 2021 earnings last evening.

- Sales were up +9% organically y/y which is a typical pre-covid growth rate for SYK.

- Elective procedures pressure due to covid impacted Hips & Spine business, while knees, trauma and other did better than expected.

- Mako growth of +27% in 2021, with an installed base of robots of 1,500! Like mentioned before, new competitors entering the marketplace is actually triggering interest in Mako and new trials, resulting in additional wins.

- Gross margin pressure from: business mix, employee absenteeism, inflation (steel, electronics, transportation)

- Cost discipline helped offset some of the inflation impact

FY22 guidance:

- Top line growth +6-8% organic – we view this as great considering continued covid pressure

- Gross margin pressures result in 50-100bps contraction y/y

- EPS $9.60-$10.00 shows lower operating leverage than expected (supply issues with electronics)

Why is the stock down today?

- Macro headwinds continue to pressure margins

- Guidance for FY22 is somewhat muted by all the covid/supply chains/inflation uncertainty pressuring EPS growth

Why do we still like the stock?

- Diversified revenue drivers, premium products offered help the company gain market shares

- Strong order book for capital products from hospitals

- Mako robots still best-in-class and ahead of competitors

- M&A actions have typically been additive to SYK. Recent Vocera deal is neutral to EPS this year

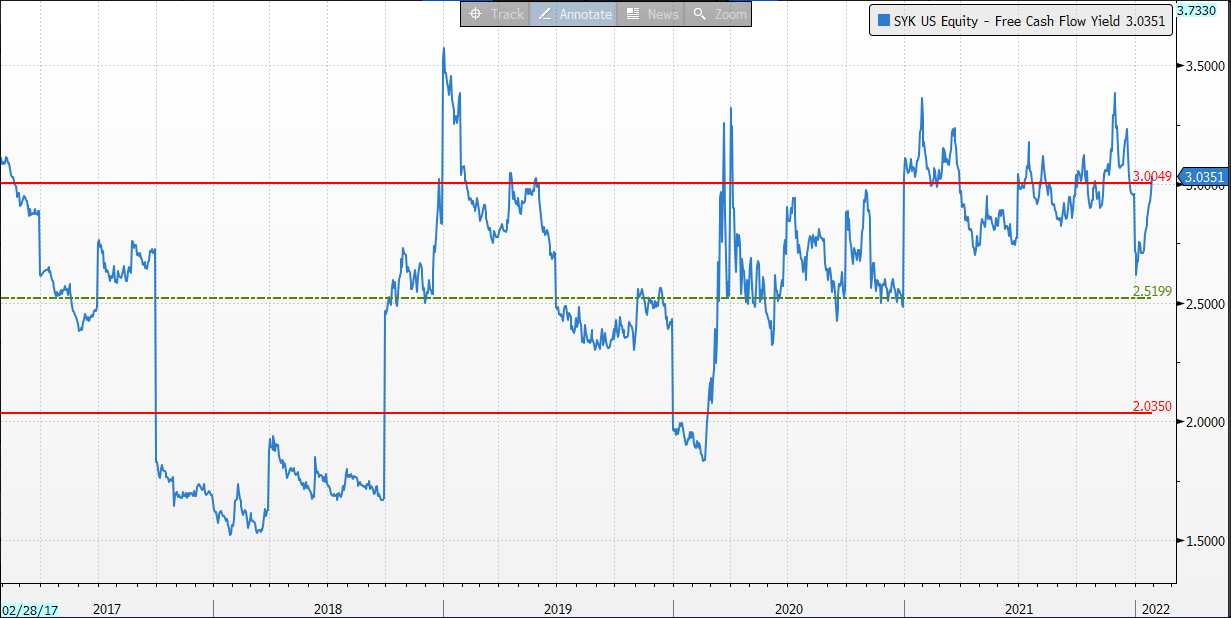

Valuation is not expensive due to continued covid pressure. Long-term thesis is intact so I recommend to take advantage of recent weakness and add to SYK in any account that is underweight SYK vs. our model.

SYK Thesis:

- Consistent top and bottom line growth in the mid and upper single digits respectively

- Continued operating leverage of current infrastructure

- Strong balance sheet and cash flow used in the best interest of shareholders

$SYK.US

[category earnings] [tag SYK]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109