Current Price: $66 Price Target: $83

Position Size: 3.7% TTM Performance: 30%

Key takeaways:

- Positive call; seeing robust demand – Revenue was strong but slightly below consensus. Sales levels are well ahead of pre-pandemic. For the year, “open-only” SSS were +15% (in the US +17%). These open-only same store sales compare FY22 sales (calendar 2021) to FY20 sales (calendar 2019). HomeGoods remained the standout, with comps +22%.

- Sales were trending higher before Omicron surged.

- Seeing higher than expected freight and wage pressure – margins were negatively impacted but somewhat offset by operating leverage on higher sales and higher merchandise margin (driven by multiple factors including mix and taking price in select categories). When freight pressures abate, margins will expand.

- Seeing extremely plentiful inventory buying opportunities – “we can’t emphasize this enough, availability of quality branded merchandise is excellent across good, better and best brands.”

Additional Highlights:

- Quotes from the call…

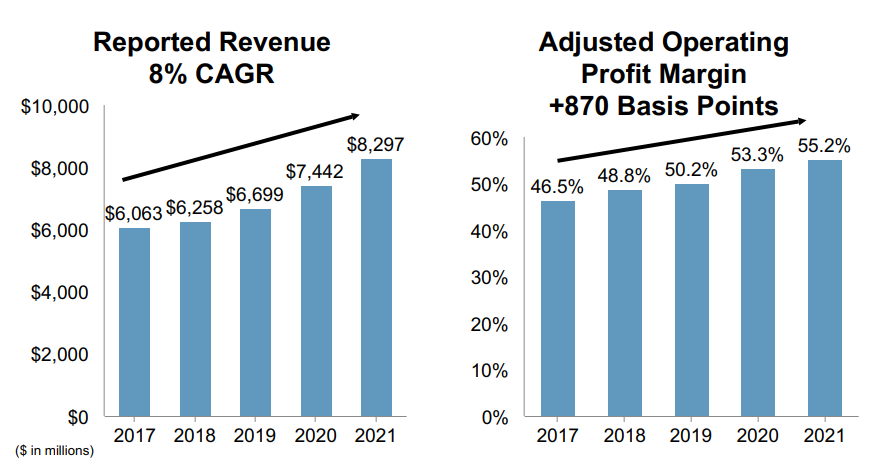

- “we remain highly focused on improving our pre-tax margin profile. We continue to believe that our initiatives to drive sales are the bast was to offset the current levels of cost pressures we-re facing.” Mid-single-digit top line growth combined with margin expansion and buybacks should lead to compounding FCF/share double digits.

- “I’m looking at this inflationary price increase as a major opportunity for us at TJX, to get even more aggressive about adjusting our retails than we’ve been”…”we’ve had such strong success if you look at Q4 merchandise margin”… “we are feeling like there’s more significant room for improvement over the next year or two.”

- Sales are tracking ahead of pre-pandemic levels…

- Overall fully year sales were $48.5B, over $7 billion more than calendar 2019, pre-pandemic despite significant store closures internationally during the year.

- FY open-only comp sales vs pre-pandemic (calendar 2021 vs calendar 2019)

- Overall: +15%

- Marmaxx U.S. +13%

- HomeGoods U.S. +32%

- Canada +8%

- International +6%

- For the full yr. merchandise margins were up despite higher wages and higher freight– They’re offsetting higher costs w/ strong mark-on and lower markdowns. Incremental freight costs in 4Q weighed on GM, were a 200bps headwind for the full yr., and are expected to peak in Q1, but should moderate in 2H23. HomeGoods margin is disproportionately impacted by freight increases due to its product mix. While higher wages will stay, freight pressures are expected to improve, which should benefit margins.

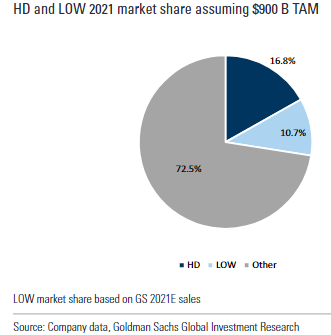

- Long-term thesis intact – Relative to other brick-and-mortar focused retailers, TJX continues to have a superior and very differentiated model. They acquire their inventory from an enormous (and growing) network of vendors, acting like a clearing mechanism for the retail industry…essentially opportunistically buying leftover/extra product that constantly flows from retailers, branded apparel companies etc. Growth of e-commerce has led to better inventory opportunities/ selection, not worse. They leverage their massive store footprint and centralized buying to merchandise their stores and e-commerce sites w/ current on-trend product. No one else does this at the scale they do. Their immense buying, planning and allocation, logistics teams are helping them navigate the current environment. They have very quick inventory turns and can be nimble and re-active w/ their inventory buys and are an important partner to their sources of inventory…and becoming even more important. It’s a powerful model that continues to take share and, while they have a growing e-commerce business too, their store model has been very resistant to e-commerce encroachment. Moreover, they have a thriving Home business, a growing e-commerce presence, an expanding international store footprint and a track record of steadily positive SSS. Prior to last year, in their 44 year history they only had 1 year of negative SSS (this is unheard of!). So, with steadily positive SSS, a slowly growing store footprint and an emerging e-commerce business, TJX steadily grows their topline w/ consistent margins that are about double that of department stores.

- Valuation: strong balance sheet, they’ve returned to their capital allocation program w/ dividend and buybacks and the valuation is reasonable at >4% FCF yield on next yr.

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

$TJX.US

[tag TJX]

[category earnings]