Key Takeaways: I recommend adding to ST on stock weakness today in accounts that have a smaller position in ST. Long term thesis remains, with attractive long term secular growth drivers and attractive valuation.

Current Price: $56 Price Target: $75 NEW ($61)

Position Size: 1.57% 1-year Performance: +4%

Sensata released their 4Q21 earnings report this morning: top line came above expectations, but guidance for margins in FY22 is below top line growth, not surprising considering the inflationary environment, but causing the stock to underperform the market today.

- Sales were +3.1% overall (-0.9% organic), with growth by segments as follow:

- Automotive organic sales -12%: ST outgrew the market by 520bps – revenue decline due to OEM production reductions (supply chain constraints)

- HVOR organic revenue +16% y/y: outgrew the market by 1,700bps

- Aerospace sales -1% with 790bps market outgrowth

- Industrials sales up +16% with 850bps market outgrowth – due to HVAC market recovery and launch of new products around electrification needs

- The electrification theme is a big growth driver for Sensata, with the potential to generate $1B in revenue in a few years, in areas such as electric vehicles, heavy vehicles, and clean energy demand

· As forecasted last quarter, supply chain constraints were higher in 4Q vs prior quarters

· Adjusted EPS grew 2.4% y/y

· Net leverage ratio is 2.8x and expected to be 2.2X by year end

· New buyback authorization of $500M. $48M of shar ebuyback was done in Q4

2022 initial guidance:

- Sales up +6% to +10% organically

- End market growth ~4% overall

- OEM production outlook for 2022:

- Auto production +7%

- The aerospace sector +7%

- Industrial -1%

- HVOR flat

- 90 bps impact on margin from increased R&D spending

- Higher labor costs and raw materials will impact earnings in FY22

- EPS $ 3.80 to $4.06 is $0.11 below the Street expectations

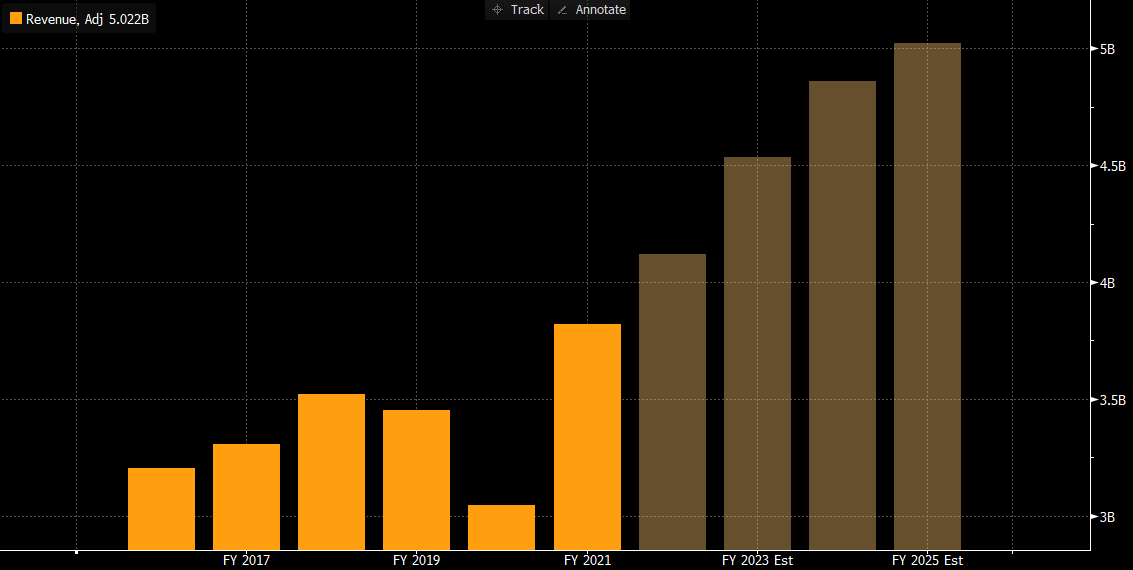

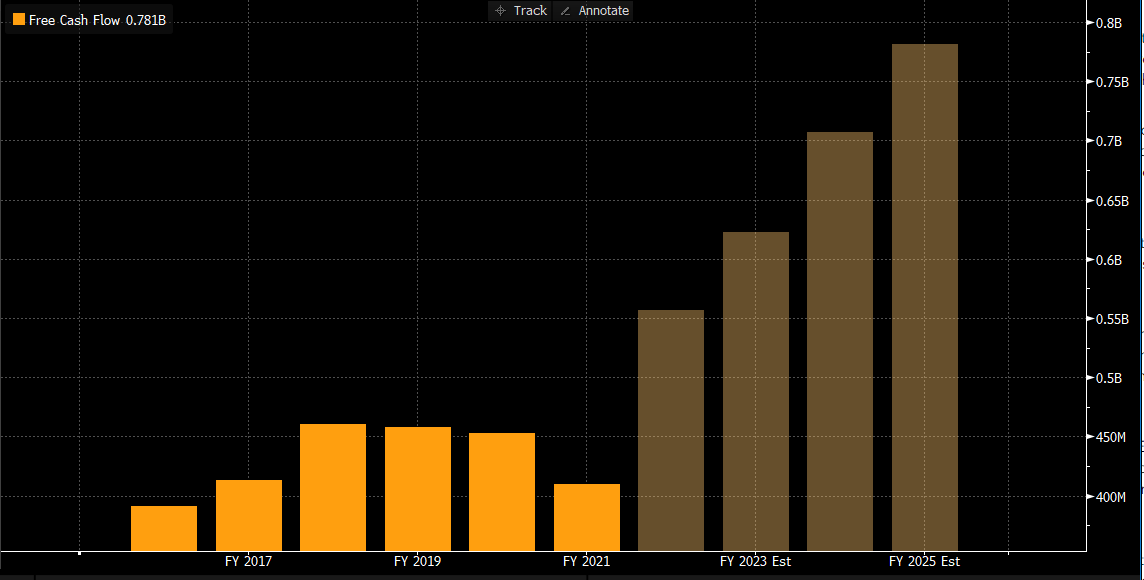

While FCF was lower this past quarter, we expect a rebound in the coming year as supply chain issues resolve themselves and demand for ST products continue to outperform the market. Below is a graph of Sensata revenue and FCF from 2016-2021 and 2022-2025 expectations -clearly on a growth trajectory from all the recent investments in growth areas (example: electrification of cars):

The Thesis on Sensata

- Sensata has a clear revenue growth strategy (content growth + bolt-on M&A)

- ST is diversifying its end markets exposure away from the cyclical auto sector over time through acquisitions, also expanding its addressable market size

- ST is a consolidator in a fragmented industry and still has room to acquire businesses

- Margins should expand as the integration of the prior two deals is under way, regardless of top line growth, and efficiencies in manufacturing are continuously pursued as they are gaining scale

- ST is deleveraging its balance sheet post acquisitions, leaving room for future M&A or a return to share buybacks, and improving EPS growth

Tag: ST

category: earnings

$ST.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109