Key Takeaways:

Current Price: $195 Price Target: $280

Position Size: 2.41% 1-year Performance: +0%

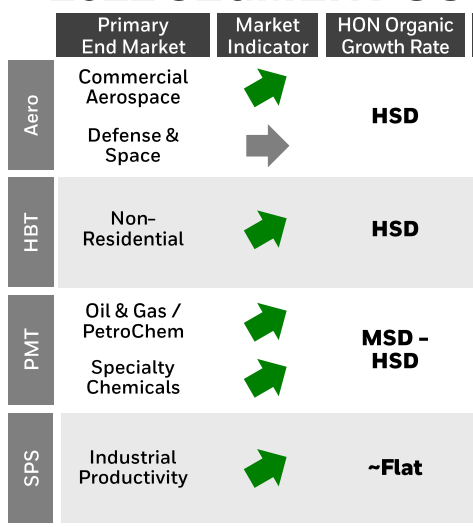

Honeywell reported 4Q21 earnings this morning. Organic sales were down 2%, with segments as follow:

- Aerospace -3% (commercial aerospace was positive but defense -18%). Defense decline was driven by semiconductor, labor and supply chain issues

- Performance Materials +2%

- Building -1%: decline due to supply chain issues but also lower project volume

- Safety -6% due to lower masks sales and Intelligrated contracts

- Supply chain issues reduced sales in Q4 by `150bps

Margins missed expectations due to Safety & Productivity segment margin decrease of 450bps y/y, although Aerospace (+140bps) and Performance Materials (+430bps) were strong.

Honeywell will have its Analyst Day in March, and we think they will provide more color on each segment’s growth drivers. Honeywell has many moving parts within its business, and we don’t expect all of them to go upward at the same time. It is reassuring to see Aerospace recovery (although below expectations).

CFO quotes:

- “the backdrop for 2022 does have a number of uncertainties in it, the ongoing global pandemic, continued supply chain constraints, accelerated inflation and labor market challenges”.

- “we continue to see promising signs of recovery unfolds as well as encouraging wins in our key markets”

FY22 guidance:

- Organic sales growth of 4-7% – with pricing of +4% (market leader indicator) – On the volume side: we think the lower end of guidance at 0% volume growth is disappointing – while 3% seems good at this point of the recovery

- The CEO commented on masks sales in light of guidance as a “bunch of noise” in the first half… overall for the year masks sales are adding 1% growth to top line

- “So we came out with a guidance that I think is fair. I don’t know if you want to call it aggressive or conservative, but it does assume a pretty good step-up in the second half, probably not inconsistent with some of those peers. But what none of us know, and that includes Honeywell and others is, exactly what will happen in the second half. So we’ve built in a ramp, but we also feel like it’s a ramp that can be met. So, we’ll — and we’ll adjust as we go through the year.”

- Operating margin is expected to increase 10-50bps (or 40-80bps if they exclude the Quantum computing investments) – this is reassuring to see expansion above current levels, although guidance came below consensus numbers as HON continues to invest in Quantum:

- Quantum computing (“Quantinuum”) should bring in $20m in revenue this year, with a target of $2B in 2026

- The stock is down today as FY22 guidance is lower than the already lowered EPS expectations. The $8.40-$8.70 guide implies a 4-8% EPS growth, below consensus. Most expected 2022 to see the start of the recovery from supply chain issues.

- FCF $4.7B-$5.1B, below expectations of $5.99B. HON continues investing in key growth projects such as Quantum, that will eventually bring in revenues.

Overall, this past quarter was soft, as expected from prior comments made by the company and 2022 guidance is embedding some uncertainties in supply chain recovery in 2H, as should be. However, we still think Honeywell long-term thesis is intact, and would take advantage to today’s weakness and add to the position in accounts with a lower position than the model.

Investment thesis:

Secular growth drivers:

A/ Aerospace segment recovery near-term, remains long-term growth driver

- Air travel recovery

- Defense exposure provides stability

B/ Tech within Industrial: leveraging its industrial base to build a connected software platform creates a leading market position & increase resiliency across market cycles

- Quantum Computer

- Connected Enterprise

- Automation / integrated supply chain

- Digital/Cybersecurity

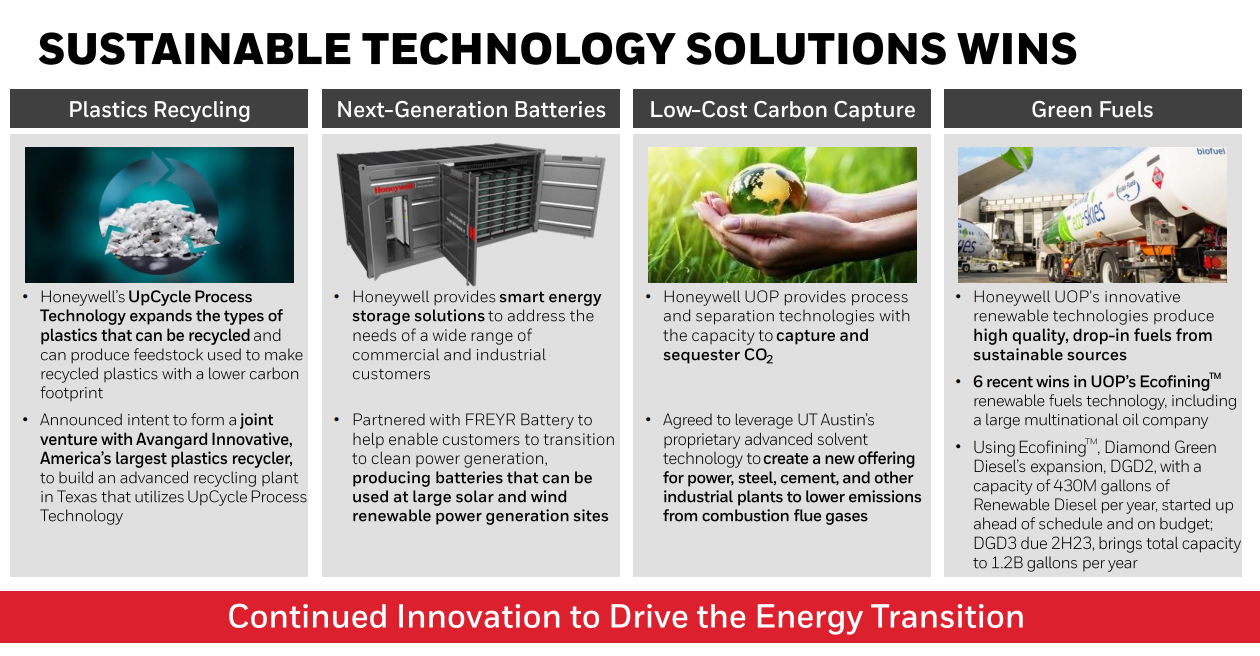

C/ Sustainability focus: increasing demand from customers for solutions that enhance sustainability

- Sustainable fuel

- Electric/hybrid aircrafts – partnership with various OEM

- Plastic recycling

- Sustainable Buildings

Tag: HON

category: earnings

$HON.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109