Following a tumultuous week in industrials, I wanted to add some colors on why we are underperforming in our Select Equity industrials portfolio and some actions we are taking:

- Adding 50bps each in HON and XYL from cash/IVV: long-term thesis and drivers are still in place; we expect to see a recovery in aerospace (HON) and continued spending by utilities towards clean water across the globe (XYL). Recent supply chain issues are temporary.

- Both should see their multiples expand as they see base business recover from recent turbulences & monetize their growing software offerings over time

- On a DCF basis, HON and XYL have the most upside from current levels

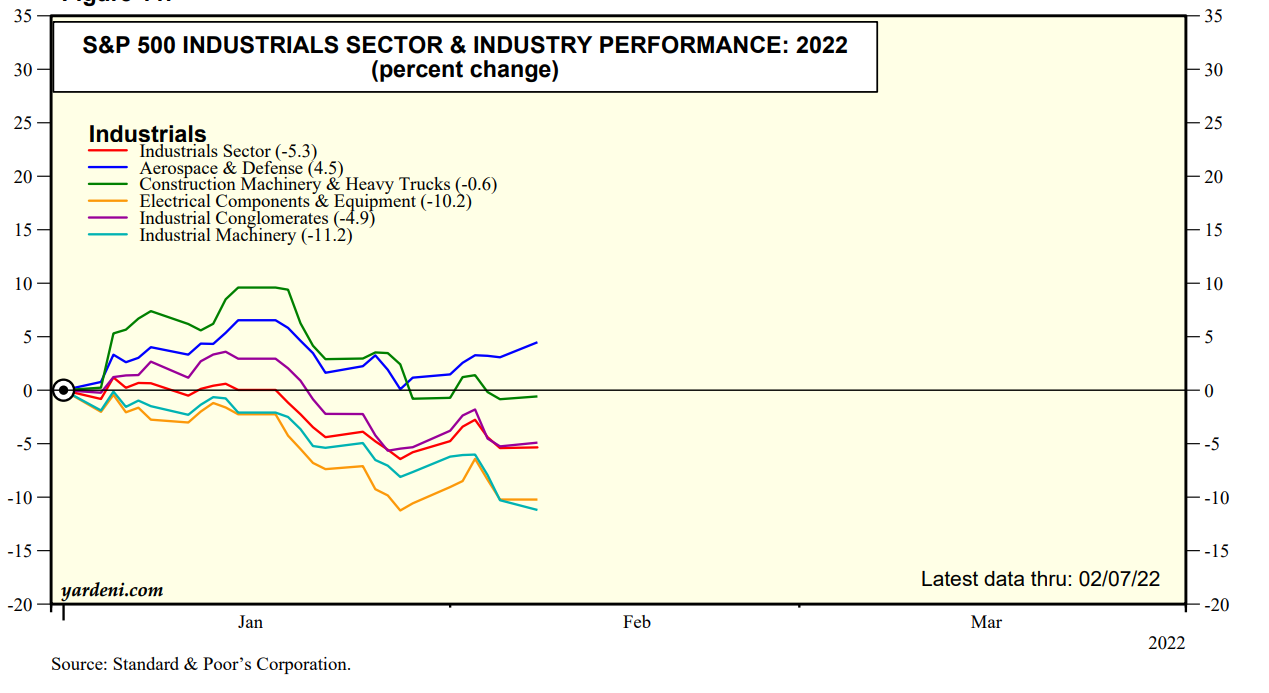

Why is our Industrial sector underperforming?

- Highly cyclical names have outperformed since early 2021 (airlines / construction)

- We don’t have highly cyclicals names in industrials portfolio

- XYL, ST, FTV and HON are high quality names with good growth drivers

- “green” stocks have underperformed (after outperforming in 2020) – in part due to:

- Rising interest rates (inflation) means higher cost of doing business for non-profitable businesses is tough to weather (think solar/renewable energy companies)

- Investor getting out of those names into more cyclical companies: I think XYL was thrown out with the bath water – our worst performer YTD in Industrials

- Multiple contraction & delay in transforming orders into sales due to supply chain issues

- Defense names have done better due to Russia/Ukraine fear. Reminder that LMT top line and FCF profile is not as attractive as it was pre-2021: expect top line decline in 2022 and low 2% growth in 2023 with FCF drop in 17% drop in FCF in 2022 and 2% growth in 2023…not exciting

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109