Current Price: $308 Target Price: $410

Position size: 2.3% TTM Performance: +15%

Key Takeaways:

- Recommend buying on weakness to ensure full position size

- Better than expected results but conservative guidance – SSS were +8.1% as elevated home improvement demand persists. They issued conservative guidance given uncertainty around inflation, supply chain dynamics and how consumer spending will evolve through the year.

- Long-term growth drivers for home improvement sector remain intact – while rising rates may be a headwind to home prices, low housing inventory is an offset that supports prices and drives new housing construction. That combined w/ an aging housing stock all drive repair & remodel activity.

- CEO transition – New CEO Ted Decker was COO and w/ HD since 2000. Craig Manear will now serve as Chairman.

- Increased dividend and buybacks – increased quarterly dividend by 15%. Returned $22B to shareholder through buybacks ($15B) and dividends ($7B).

- CEO Quote: “The broader housing environment continues to be supportive of the home improvement. Demand for homes continues to be strong, and existing home inventory available for sale remains near record lows, resulting in support for continued home price appreciation. On average, homeowners’ balance sheets continue to strengthen as the aggregate value of US home equity grew approximately 35% or $6.5 trillion since the first quarter of 2019. The housing stock continues to age, and customers tell us the demand for home improvement projects of all sizes is healthy.”

Additional Highlights:

- Secular tailwinds persist…more homes need to be built. This should be a LT secular driver for HD.

- Undersupply of homes continues to support pricing and years of underbuilding has shifted the age of the existing US housing stock – both of which support home improvement spending.

- According to a recent study by the National Association of Realtors, due to years of underbuilding, the US is short 6.8 million homes.

- Building would need to accelerate to a pace that is well above the current trend…. To more than 2 million housing units per year vs a ~1.6m annual rate for starts.

- From the NAR report released in June…“Following decades of underbuilding and underinvestment, the state of America’s housing stock, which is among the most critical pieces of our national infrastructure, is dire, with a chronic shortage of affordable and available homes to house the nation’s population. The housing stock around the nation has been widely neglected, with a severe lack of new construction and prolonged underinvestment leading to an acute shortage of available housing, an ever-worsening affordability crisis and an existing housing stock that is aging and increasingly in need of repair.”

- Updated their total addressable market (TAM) estimates…

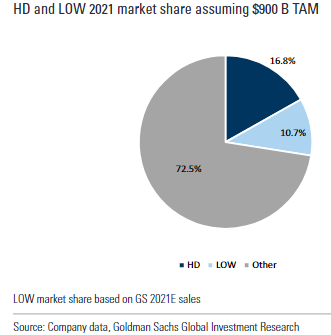

- They updated their N. American TAM estimate from $650B to $900B with Pro and DIY each representing 50% and with MRO accounting for $100B of Pro. They also provided a long-term sales target of $200B. At a mid-single-digit CAGR, they would hit this in 2029. HD has about 17% share and LOW has ~11%… the other ~72% is pretty fragmented providing lots of opportunity to take share which is supportive of their LT growth targets.

- Solid current trends:

- Hit >$150B in revenue in 2021. They’ve grown their business by over $40B in the last 2 years after double-digit comp growth for fiscal 2021 on top of nearly 20% comp growth in fiscal 2020.

- SSS of 7.3% in November, 10.2% in December and 7% in January. SSS in the US were positive 7.6% for the quarter, with SSS of 7.2% in November, 10.9% in December and 5.4% in January.

- Inflation in things like lumber is a significant tailwind to SSS – in Q4 alone, the pricing for framing lumber ranged from approximately $585 to over $1,200 per thousand board feet, an increase of more than 100%.

- Pro sales growth outpacing DIY – Pro is now 50% of total, increasing as a part of the mix as consumers resume large projects and return to pre-pandemic activities.

- GM was 33.6%, a decrease of approximately 30bps from last year, primarily driven by product mix and investments in their supply chain network.

- Big-ticket comp transactions or those over $1,000 were again up approximately 18%, indicative of strong consumer environment

- E-commerce sales were +9% for the yr. and up >100% over the past 2 years.

- Why we like it…

· Multiple long-term growth drivers: durable housing trends, taking share in a fragmented home improvement market w/ DIY & Pro, and growing their more nascent MRO business (particularly after HD Supply acquisition) and leveraging their best of breed omni-channel model.

· Best of breed omni-channel model drives productivity:

o By adding specialized warehouse capacity and enhancing digital capabilities (online and in the store), HD is uniquely positioned to leverage their existing retail footprint (not really growing stores) and drive steadily high ROIC that is ~45% (which is incredible). They continue to add new bulk distribution centers (used replenish stores with lumber and building materials), flatbed distribution centers (which are often tied to the bulk distribution centers), MDOs (market delivery operations are used to flow through big and bulky products, particularly appliances). and adding direct fulfillment centers for e-comm fulfilment which will allow them to cover 90% of the country in same or next-day delivery.

o They dominate the category, are the low cost provider, have a relentless focus on productivity and can continue to flow an increasing amount of goods through their big box stores w/ omni-channel. This is a highly efficient model as 55% of online sales are picked up in-store which HD can fulfill from the store or nearby warehouses.

· Capital allocation: they’ve resumed share repurchases and remain committed to growing their dividend over time.

· Valuation: Strong balance sheet, benefiting from strong housing trends but also has defensive qualities and a reasonable valuation, trading at >5% forward FCF yield.

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

$HD.US

[tag HD]

[category earnings]