Key Takeaways: I recommend trimming CVS by 1% following a strong year of performance. FY22 should see lower FCF (some pull forward into 4Q21) due to lower covid-19 positive impact on pharmacy, so I prefer lowering our active exposure. We are adding the proceeds to SYNH where I see higher upside, after a pullback in the name YTD.

Current Price: $105 Price Target: $118

Position Size: 2.65% 1-year Performance: +50%

CVS reported 4Q21 earnings this morning with EPS largely ahead of consensus, up 52.3% y/y and revenue growth of 10.6% reflecting growth across all segments. Health Care Benefits grew 10%, with medical memberships growing 1.7% (driven by government contracts up 7.7%). Pharmacy services grew 8.2%, thanks to 8.2% growth in claims, specialty pharmacy (+12%) and brand inflation. The Retail/Long-term care segment grew 12.7%, helped by front store volume growth & covid-19 vaccinations/testing, while reimbursement pressure continues. Their retail pharmacy market share (based on total scripts) grew 60bps y/y (now 26.7%). Overall CVS benefitted from the Omicron surge as Q4 saw strong vaccine & testing demand ($1.2B in sales in Q4 alone), which we don’t expect to continue at this time. On the other side, a reduction in sickness will help their Health care benefits segment with lower expenses.

Regarding the civil investigative demand received January 2022 from the DOJ on pharmacy practices around opioid prescriptions, CVS defended itself by saying they were filling up prescriptions written by doctors…

CEO quote: “our stance here is very similar to where it’s been all along. Our fundamental position is that these prescriptions were written by doctors, not pharmacists. We did not manufacture or market these. And the healthcare system does rely on pharmacists to fill legitimate prescriptions that doctors are deeming necessary. So, based on that, we strongly disagree with the recent Court decision in Ohio. And we look forward to appeal a Court review of that case. And I’ll remind you there that was a ruling on liability only, not on damages”

FY22 guidance update from December investor day since we now have 2021 numbers to compare:

· Revenue growth 4%-6%

· Adjusted EPS $8.10-$8.30 (consensus at $8.27)

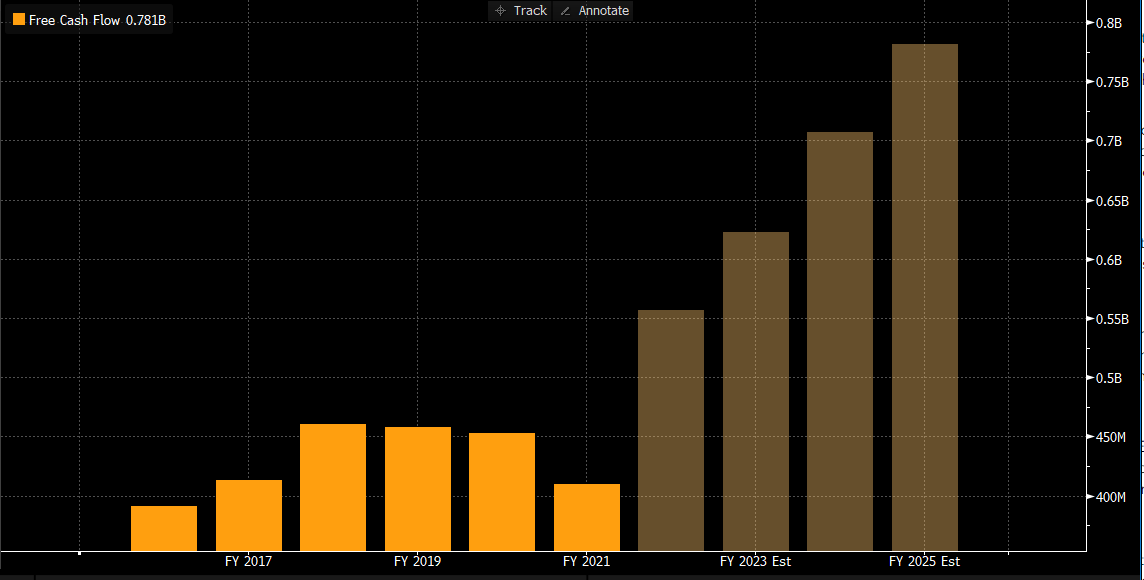

· CFO $12-$13B – was reduced by $0.5B from previous guidance on the lower end due to timing of collection in 2021 from 2022

CVS expects COVID-19 vaccine volume to decline 70-80% from 2021 levels and covid testing to decline 40-50%, not surprising as we move further away from the pandemic into an endemic situation. This assumes no 4th booster shot to be done.

CVS will be adding another business to its portfolio over time, adding primary care groups through M&A. The CEO is looking for regional or national groups who can handle the complexity of Medicare patients. CVS will be looking for teams to add that have a solid management team that they can retain through the merger, with a clear pathway to profitability. And while primary care is their focus right now, home health follows on the list of potential adds over time.

Thesis on CVS

- Market leader: largest pharmacy benefit manager (PBM) in the US. This gives CVS scale advantage and negotiating power with pharma companies to obtain better drug pricing discounts. Also the largest US pharmacy retailer, giving it more touch points with consumers/patients. Finally, market share leader in long-term care pharmacy sector thanks to its Omnicare acquisition.

- Aetna acquisition makes it vertically integrated.

- Stable and predictable top line and margin profile. CVS benefits from an ageing population in increasing needs of prescription drugs.

- shareholder friendly, offering a 7% shareholder yield (5% share repurchase + 2.6% dividend yield)

$CVS.US

Category: earnings

tag: CVS

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109