Applied Finance Select Fund Commentary – Q4 2021

Thesis

AFVZX serves as our active manager in the large cap “value” U.S. equity markets and follows a concentrated (50 companies) investment strategy that focuses on firm quality and valuation. By utilizing DCF models, bottom-up fundamentals, and holding sector weights that are equivalent to their benchmark (S&P 500 Index), the fund generates alpha over time purely through stock selection. We continue to hold AFVZX because of the team’s ability to compare stocks across all sectors which enables them to generate strong returns over the long run.

[More]

Overview

In the fourth quarter of 2021, AFVZX underperformed the benchmark (S&P 500 Index) by 155bps. U.S. large-cap equities saw strong performance for quarter, especially in October and early November when news of an antiviral Covid pill was shared. Additionally, strong personal income growth and manufacturing data which pointed to a recovering economy helped drive equity markets. Supply chain bottlenecks and labor shortages still acted as a headwind, though. Inflation also disrupted optimistic sentiment and caused continued volatility in equity markets.

Q4 2021 Summary

- AFVZX returned 9.48%, while the S&P 500 Index returned 11.03%

- Top contributors

- Health Care: Pfizer, McKesson

- Communication Services: Alphabet

- Energy: Chevron

- Materials: CF Industries

- Top detractors

- REITs: Host Hotel & Resorts

- Consumer Discretionary: Target, Darden Restaurant

- Information Technology: Intel Corp, International Business Machines Corp, Fiserv, MasterCard

- Financials: Capital One Financial Corp, The Allstate Corp

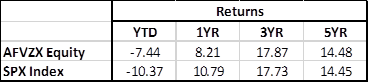

2021 Performance Comparison

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109