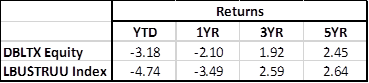

DoubleLine Total Return Bond Fund Commentary – Q4 2021

Thesis

DBLTX (yielding 3.24%) utilizes a top-down, bottom-up process that focuses on MBS and Agency bonds. When compared to the benchmark (Barclays U.S. AGG), the holdings have lower duration and exposure to corporate bonds, reducing their sensitivity to interest rate movements and credit spreads. We expect attractive risk-adjusted return characteristics over the long term from DBLTX, especially during periods when corporate bonds’ spread increase and the yield curve steepens.

[more]

Overview

In the fourth quarter of 2021, DBLTX outperformed the benchmark (Barclays U.S. AGG) by 19bps, largely due to the fund’s shorter duration – Fed monetary policy expectations caused the curve to begin to flatten: 2-year rates began to rise, and 30-year rates slightly dropped. A strong housing market and floating-rate coupons contributed to performance, though.

Q4 2021 Summary

- DBLTX returned (0.18%), while the U.S. AGG returned 0.01%

- Quarter-end effective duration for DBLTX was 4.82 and 6.60 for the U.S. AGG

- Top performing sectors included non-Agency residential mortgage-backed securities and CLOs

- Worst performing sectors included non-Agency commercial mortgage-backed securities, asset-backed securities, and Agency MBS

2021 Performance Comparison

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109