Eaton Vance Floating-Rate Fund Commentary – Q4 2021

Thesis

EIBLX (yielding 3.15%) is a large floating rate fund that has strong historical returns and a tenured management team. By investing purely in senior bank loans, EIBLX further increases our potential upside gain, reduces our duration-risk, and decreases our interest rate risk. We like that the fund utilizes a bottom-up investment process through proprietary framework analysis, avoids high-yield corporate bonds, and allocates to relatively higher-rated securities within the floating rate security space.

[More]

Overview

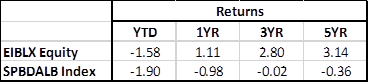

In the fourth quarter of 2021, EIBLX underperformed the benchmark (S&P/LSTA Leveraged Loan Index) by 26bps. Loan markets in general saw prices ease on October and November, but a strong and quick rally in December as Omicron fears started to fade and interest rate hike talks made headlines. Q4 2021 was also a record quarter for supply and demand which helped drive strong performance – CLOs specifically broke records. Credit also remained healthy with the default rate ending the year near a record low.

Q4 2021 Summary

- EIBLX returned 0.51%, while the Leveraged Loan Index returned 0.77%

- Quarter-end effective duration for EIBLX was 0.36 and 0.12 for the Leveraged Loan Index

- Largest contributors

- Overweight to a specialty chemicals company and out-of-benchmark holding in a recovering metals/mining issuer

- Largest detractors

- Overweight holding in an energy company and overweight to a radio & television credit

2021 Performance Comparison

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109