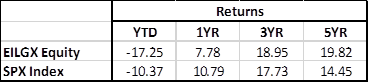

Atlanta Capital Focused Growth Commentary – Q4 2021

Thesis

EILGX serves as our active manager in the large cap “growth” U.S. equity markets and follows a concentrated (20-30 companies) investment strategy with a heavy quality tilt emphasizing companies with high ROIC, strong cash flow multiples, and long-term moats. By utilizing DCF models and bottom-up fundamentals, the fund finds stocks with secular tailwinds, sustainable financials, and relatively low downside capture to generate alpha over the S&P 500 Index over time. We continue to hold EILGX because of the team’s ability to build a concentrated portfolio that gives our U.S. large-cap allocation a strong quality tilt, while giving clients strong risk-adjusted returns.

[More]

Overview

In the fourth quarter of 2021, EILGX underperformed the benchmark (S&P 500 Index) by 72bps. Even though inflation and Covid-19 threatened to disrupt returns, U.S. large-cap markets still saw strong returns. This is largely due to positive anticipation for an ongoing recovery and Fed action to mitigate inflation impacts. Specifically related to the fund, underperformance was mainly driven by negative sector allocation in Health Care and Information Technology. Stock selection also detracted from total return.

Q4 2021 Summary

- EILGX returned 10.35%, while the S&P 500 Index returned 11.07%

- Top contributors

- Stock selection within Health Care, Financials, Communication Services, and Consumer Discretionary

- Overweight to Materials

- Top 5 stocks: Zoetis Inc., Thermo Fisher Scientific, Inc., Amphenol, lack of exposure to Amazon.com, Inc., and Paypal Holdings

- Top detractors

- Stock selection within Information Technology, Real Estate, Materials, and Industrials

- Underweight to semiconductor and technology hardware

- Overweight to Health Care and underweight to Information Technology

- Worst 5 stocks: lack of exposure to Tesla, Apple, Inc., NVIDIA, Inc., Visa, Inc., and Fiserv

2021 Performance Comparison

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109