Fidelity Advisor Floating Rate Fund Commentary – Q4 2021

Thesis

FIQSX (yielding 3.26%) is a large, floating rate fund that has strong historical returns and a tenured management team. By investing purely in senior bank loans, FIQSX further increases our potential upside gain, reduces our duration-risk, and decreases our interest rate risk. We like that the fund utilizes a bottom-up investment process through proprietary framework analysis, avoids high-yield corporate bonds, and allocates to relatively higher-rated securities within the floating rate security space.

[more]

Overview

In the fourth quarter of 2021, FIQSX performed roughly in line with the benchmark (S&P/LSTA Leveraged Loan Index). In general, loans saw stronger performance than high-yield corporate bonds, IG corporate credit, and other broad-based IG markets. Issuance reached an all-time high in October which was matched by high demand from CLOs and retail funds. November then saw a slight drop, but a strong rebound in December largely due to Omicron concerns. Headlines around rising interest rates also sparked demand for floating rate securities which helped drive performance.

Q4 2021 Summary

- FIQSX returned 0.79%, while the Leveraged Loan Index returned 0.77%

- Quarter-end effective duration for FIQSX was 0.16 and 0.12 for the Leveraged Loan Index

- Largest contributors

- Murray Energy (coal mining), Rivian Automotive (EV manufacturer), not owning Envision Healthcare (health-care service provider)

- Largest detractors

- Out-of-benchmark holding in TNT Crane & Rigging (crane service provider), Sinclair Broadcast Group (TV station operator), Rodan & Fields (skin case company)

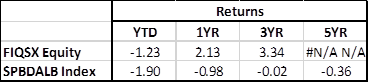

2021 Performance Comparison

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109