Harding Loevner Emerging Market Fund Commentary – Q4 2021

Thesis

HLMEX utilizes fundamental research to find companies with strong quality and growth metrics that can be compared across the global landscape. By focusing on investments with competitive advantages, long-term growth potential, quality management, and corporate strength, HLMEX offers diversity to our EM allocation while generating alpha over the long run. We continue to hold the fund because of the team’s conviction in high quality companies and managed risk through diversification and evaluation.

[More]

Overview

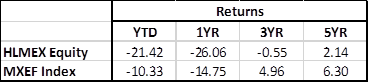

In the fourth quarter of 2021, HLMEX underperformed the benchmark (MSCI Emerging Markets Index) by 93bps. EM markets fell in the second half of the year as global inflation fears grew and a slowing to China’s growth occupied the space. Specific to the fund, poor stock selection in Financials and Communication Services detracted from returns. Strong selection in Consumer Discretionary and Utilities, and positive allocation helped performance, it was not enough to fully offset or overcome the negative returns from Financials and Communication Services.

Q4 2021 Summary

- HLMEX returned (2.17%), while the MSCI Emerging Markets Index returned (1.24%)

- Contributors

- Sector: Overweight to IT, underweight to Health Care and Consumer Discretionary

- Stocks: ENN Energy (China), Sunny Optical (China), EPAM (Eastern Europe)

- Detractors

- Sector: No exposure to Materials, Communication Services, Financials

- Stocks: Sberbank (Russia), XP (Brazil)

- Fund’s expense ratio dropped from 1.17% to 1.10% in Q3 2021

2021 Performance Comparison

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109