MetWest Total Return Bond Fund Commentary – Q4 2021

Thesis

MWTIX (yielding 1.34%) is an actively managed fund that provides a sector-based strategy while still maintaining fundamental research driven through issue selection. When compared to the benchmark (Barclays U.S. AGG), the holdings have similar duration and exposure, yet selection is focused around areas where other managers are not looking. Through sector rotation and active weighting, we expect MWTIX to generate alpha over time.

[more]

Overview

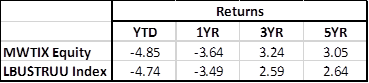

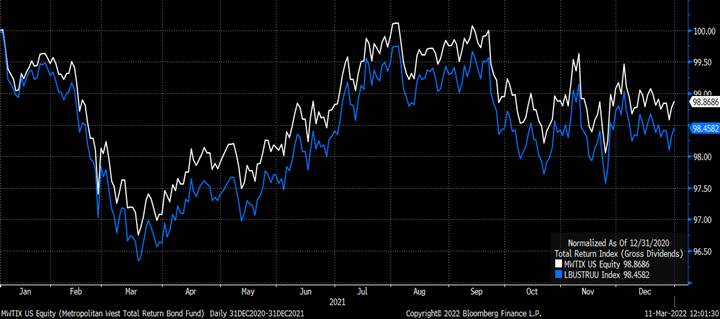

In the fourth quarter of 2021, MWTIX slightly underperformed the benchmark (Barclays U.S. AGG) by 8bps which was mainly caused by poor selection in corporate credit. Duration positioning (underweight to the long end of the curve) also acted as a headwind. Yet, the fund did see some positive performance due to its underweight to corporate credit and strong selection in the RMBS (including agency MBS TBAs and legacy non-agency MBS) space.

Q4 2021 Summary

- MWTIX returned (0.09%), while the U.S. AGG returned 0.01%

- Quarter-end effective duration for MWTIX was 6.32 and 6.6 for the U.S. AGG

- Top performing sectors included Industrials, Health Care, midstream companies, finance and life insurance names, and RMBS holdings

- Top detractors included RMBS and agency MBS holdings

2021 Performance Comparison

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109