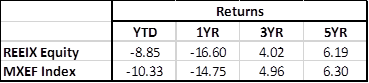

RBC Emerging Market Equity Fund Commentary – Q4 2021

Thesis

REEIX is driven through both top-down and bottom-up fundamental research that provides diversification within our full EM allocation. The fund looks for high quality companies across all market caps that have strong ESG scores. We like REEIX because of the consistent and repeatable process that allows the team to take advantage of companies with sustainable growth across all the Emerging Market (EM) landscape.

[More]

Overview

In the fourth quarter of 2021, REEIX outperformed the benchmark (MSCI Emerging Markets Index) by 211bps. While the EM market reported losses largely due to poor performance in the Chinese stock market, the fund’s underweight to the region was a large contributor to the outperformance. Strong sector allocations also had a positive impact on performance, especially within Financials, Consumer Discretionary, and Communication Services. Security selection within Financials and a flight away from quality detracted from returns. Poor selection in India and South Africa also hurt performance.

Q4 2021 Summary

- REEIX returned 0.80%, while the MSCI Emerging Markets Index returned (1.31%)

- Contributors

- Tata Consultancy services, MediaTek, Sunny Optical, NARI Technology, absence of Pinduoduo

- Detractors

- Ping An Insurance, NCSoft, B3 SA, AIA Group, Infosys

2021 Performance Comparison

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109