TIAA-CREF Real Estate Fund Commentary – Q4 2021

Thesis

TIREX utilizes fundamental research to find properties in high barrier markets, with higher occupancy and rent growth. By focusing on quality companies and avoiding unnecessary risks, the fund obtains a strong track record that has outperformed the benchmark and REIT ETF over time. We continue to hold TIREX because of the team’s growth focus with asset concentrations in supply constrained markets. Lastly, TIREX was the lowest cost active manager screened, at 49bps.

[More]

Overview

In the fourth quarter of 2021, TIREX underperformed the benchmark (FTSE Nareit All Equity REITs Index) by 62bps, almost entirely due to a single position: GDS Holding. During the quarter, the fund reduced the number of holdings as valuations became extremely elevated around Covid-sensitive property types and regions (ie. lodging and resorts). Inflation-sensitive properties like health care were also reduced. Most of these sells were reallocated towards industries that are expected to strongly rebound in a post-pandemic world, such as manufactured homes and shopping centers.

Q4 2021 Summary

- TIREX returned 15.55%, while the FTSE Nareit All Equity REITs Index returned 16.17%

- Contributors

- Industrial REITs Rexford Industrials Realty, Inc. and Terreno Realty Corp.

- Regional mall REIT Simon Property Group, Inc.

- Detractors

- China-based data center GDS Holdings Ltd.

- Not owning industrials REIT Duke Realty

- Australian-based industrial housing REIT Ingenia Communities Group

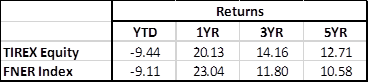

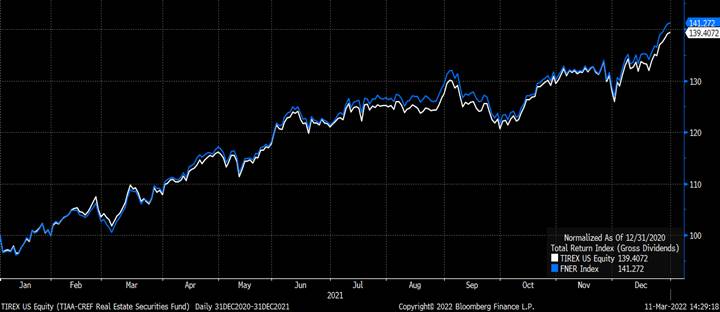

2021 Performance Comparison

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109