Western Asset Core Bond Fund Commentary – Q4 2021

Thesis

WATFX (yielding 1.72%) is an actively managed fund that finds overlooked areas of the market that can go against consensus views and add value. Through internal macro, credit, and fundamental research WATFX identifies undervalued securities and takes on more credit exposure to generate alpha over time. Through a diversified approach to interest rate duration, yield curve, sector allocation, and security selection, the fund dampens exposure to volatility.

[more]

Overview

In the fourth quarter of 2021, WATFX underperformed the benchmark (Barclays U.S. AGG) by 17bps largely due to the fund’s longer duration and exposure to EM debt. The news of the Omicron variant caused risk assets to weaken at first, but they soon rebounded upon news that this variant would cause less sever symptoms compared to past variants. Inflation continued to increase which caused the FOMC to consider increasing the pace and amount of tapering needed to combat a possible longer than expected increase in prices. The fund continues to position itself to benefit from a global recovery but may see volatile times for now.

Q4 2021 Summary

- WATFX returned (0.16%), while the U.S. AGG returned 0.01%

- Quarter-end effective duration for WATFX was 7.5 and 6.6 for the U.S. AGG

- Added exposure to short-term yields and trimmed intermediate to long-term yields

- Sold out of remaining TIPS exposure

- Increased allocation to investment-grade credit

- Continued to trim agency MBS exposure, furthering its underweight relative to the benchmark

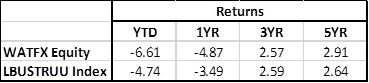

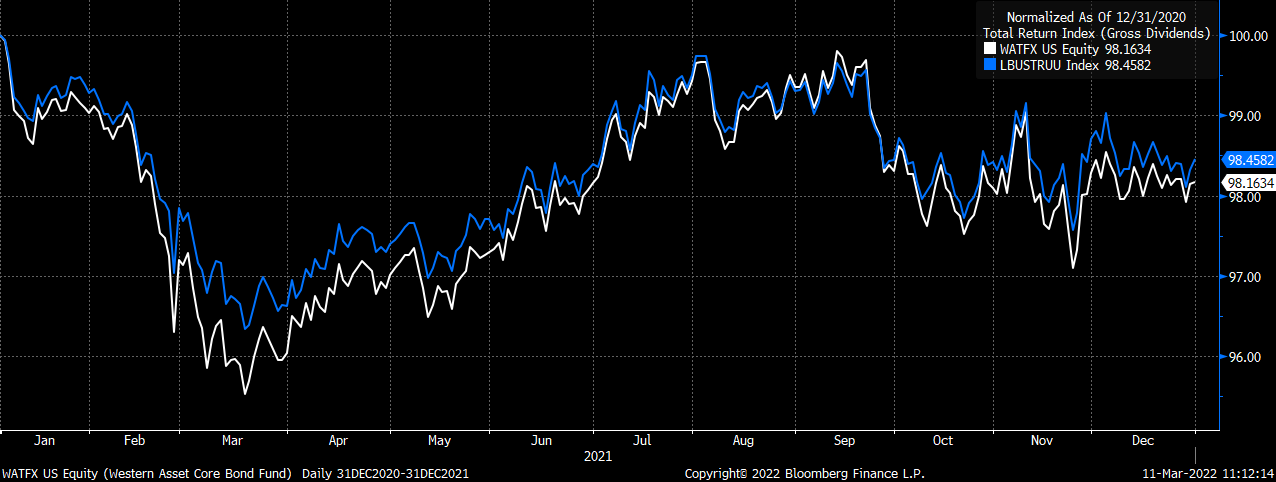

2021 Return Comparison

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109