Westwood SmallCap Fund Commentary – Q4 2021

Thesis

WHGSX is our only active manager in the small cap U.S. equity markets and applies a quality and value tilt to their investment strategy, holding between 60 and 80 companies. By utilizing bottom-up fundamentals and focusing on companies with strong balance sheets, high ROIC, and consistently high FCF yield, the fund generates alpha especially during market downturns. We continue to hold WHGSX because of the team’s ability to find cheap valued stocks in the small cap space enabling them to generate strong returns over the long run.

[More]

Overview

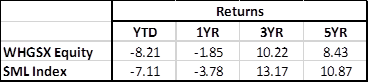

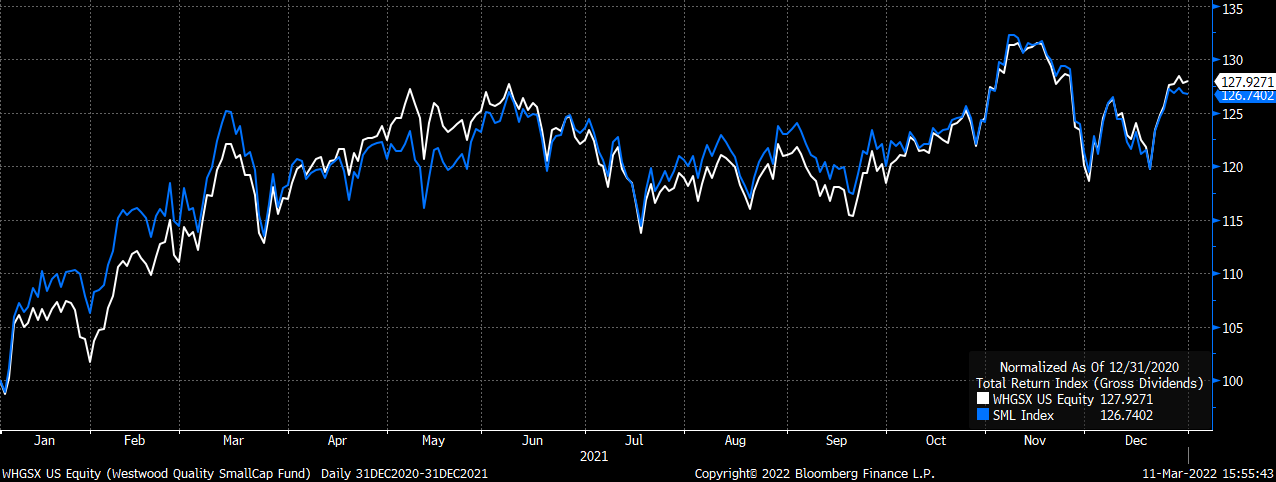

In the fourth quarter of 2021, WHGSX outperformed the benchmark (S&P 600 Index) by 240bps. Optimism over Fed policy to tamp down inflation helped create enough of a tailwind to overcome inflation fears and Washington dysfunction. As for the fund, strong security selection across numerous sectors helped drive performance. The fund saw strength across cyclical, secular, defensive, and quality areas. Industrials and Health Care were the top contributors, while Information Technology and Consumer Discretionary were the top detractors.

Q4 2021 Summary

- WHGSX returned 8.04%, while the S&P 600 Index returned 5.64%

- The fund also made a few changes to positioning

- Bought Astec Industries – producer of equipment and components used in road building and materials processing

- Bought Duckhorn Portfolio – largest pure-play luxury wine company in the U.S.

- Bought Methode Electronics – a tier-1 automotive supplier focused on electrical components and power distribution

- Bought Rambus – provider of intellectual property to the semiconductor and memory industry

- Sold

- Avient, Great Western Bacorp, James River Group, National Storage Affiliates Trust

2021 Performance Comparison

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109