Current Price: $2,342 Price Target: $3,450

Position Size: 4.8% TTM Performance: -1%

Key Takeaways:

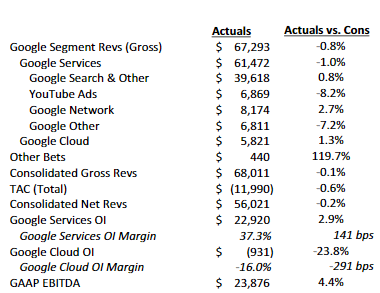

- Robust revenue growth and steady impressive margins, but saw weaker than expected ad revenue from YouTube.

- Overall, strong ad revenue continues…retail and travel-related ad spending were among the strongest sectors. Overall, ad related revenue up 23% w/ “Search & Other” revenue ($40B, up 24%), Google Network ($8.2B up 21%) and YouTube ad sales ($6.9B, up +15% YoY).

- YouTube weakness – management attributes the YouTube weakness essentially to two things: weakness in Europe, impacted by Russia/Ukraine and an increased mix of viewership of YouTube shorts (their TikTok rival product) which they don’t monetize as well as longer format videos….yet.

- Google Cloud Platform (Azure & AWS competitor) continues to do well, +44%.

- Investing behind growth as they ramp spending on Capex and headcount – continuing to pick up the pace of investment in office facilities and data centers. They recently announced plans to invest $9.5 billion in US offices and data centers, creating at least 12,000 new jobs in places like New York and Atlanta.

- Valuation –The stock reasonably valued, trading at a 5% FCF yield on 2022, cheaper than the S&P at ~4.5% and growing top line and FCF/share double digits w/ margins more than 2x the S&P. Additionally, they have almost 7% of their market cap in net cash ($106B) after generating $69B in FCF in the last 12 mos. They have been stepping up their pace of buybacks lately. They repurchased $50B in shares in 2021. And announced a $70B buyback this quarter which should support the stock. Also a 20-for-1 stock split to go into effect on 7/15.

Quote from the call on the War in Europe …

- “about 1% of Google revenues were from Russia in 2021, and that was primarily from advertising. In addition, from the outset of the war, there was a pull-back in advertiser spend, particularly on YouTube in Europe. So a couple of impacts from the war.”

More on YouTube…

- YouTube has lots of opportunity ahead despite slowing this Q in Europe and higher penetration of YouTube shorts (strong engagement but weak monetization so far).

- Positioned to capture the shift in advertising away from linear TV & strong value proposition to advertisers

- YouTube presents a great opportunity to address commercial intent w/ video in a more measurable way than linear TV

- “YouTube’s reach is becoming increasingly incremental to TV”

- YouTube helps advertisers reach audiences they can’t reach anywhere else (especially younger audiences) and helping brands do it more efficiently

- According to Nielsen, in the US, YouTube accounts for over 50% of ad supported streaming watch time on Connected TVs among people ages 18 and up. And over 35% of viewers in this group can’t be reached by any other ad supported streaming service.

- E-commerce potential: They are still in the early innings w/ e-commerce potential w/ YouTube. Possibilities include: shoppable livestream events w/ large retailers or letting viewers buy directly from their favorite creators’ videos.

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109