Current Price: $284 Price Target: $375

Position Size: 8% TTM Performance: 13%

Key takeaways:

- Broad beat & solid Q3 guidance. Azure continues to be a key driver of growth and is taking share (accelerated, +49% YoY…vs Google Cloud Platform +44% and AWS +37%).

- Enterprise software is seeing robust demand and is a deflationary force…they sell products that help companies drive productivity and deal with inflationary pressures.

- “in the conversations we are having with our customers…I don’t hear of businesses looking to their IT budgets or digital transformation projects as the place for cuts”

- ”I have not seen this level of demand for automation technology to improve productivity”

- “in an inflationary environment, the only deflationary force is software.”

- “Businesses – small and large – can improve productivity and the affordability of their products and services by building tech intensity.”

- ServiceNow’s CEO Bill McDermott (speaking on CNBC), “software is the most deflationary force in the world.”

- Big and expanding addressable markets..

- Tech is more & more strategic…and as a result is expected to double as a % of GDP by the end of the decade as companies shift spending from other areas in the organization. MSFT’s products are evolving from being primarily productivity tools to being more strategic (increasingly becoming part of the product and the go-to-market) as companies look to take advantage of new technologies (AI, AR, automation, IoT etc.) to grow and compete. So the value proposition of MSFT’s products to their customers is improving, which is key to the durability of their LT growth and profitability.

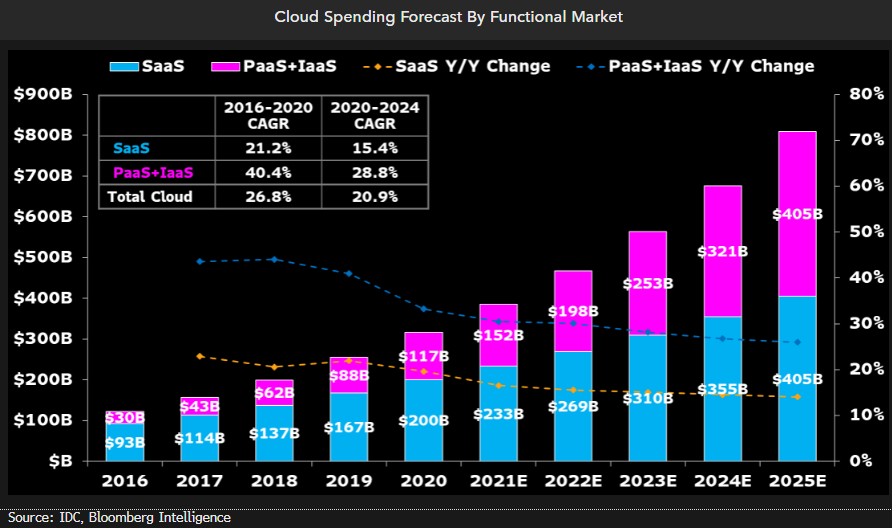

- Cloud – well positioned with lots of growth ahead (see chart below). Cloud penetration has a ways to go as only 20-30% of workloads are in the cloud. MSFT is well positioned as more large enterprises, that are longtime customers, move to the cloud and they are growing their industry specific cloud presence which should be a driver of increased penetration.

- Security –the attack surface is increasing w/ WFH and more distributed infrastructure. They have a >$15B security business (growing over 40%), making them one of the largest, fastest growing security businesses globally.

- Gaming/Metaverse/Activision Blizzard – expected to close Acquisition by July 2023; would be MSFT’s largest deal ever ($69B net of cash). This represents not only investment in their gaming business (already well positioned), but also in the metaverse – it could make Microsoft the largest player in the metaverse, and the only company with a dominant position in gaming hardware, cloud services and content. MSFT has been working on building their original game content and Activision Blizzard’s library of original games and game developer talent would add to that. In terms of the metaverse…video games represent key potential metaverse content and MSFT, w/ their HoloLens headset, has the #2 virtual reality hardware (second to Meta/FB’s Oculus headset) underpinning the immersive aspect of the metaverse. MSFT is focused on other metaverse aspects as well, including new collaboration capabilities (e.g. joining Teams meetings w/ avatars), they plan to roll out software tools related to metaverse content development and already seeing enterprise metaverse usage from smart factories to smart buildings to smart cities. They’re helping organizations use a combination of Azure IOT, digital twins and mesh to simulate and analyze any business process.

- Well positioned – entrenched enterprise customer base (better positioned for hybrid cloud adoption); superior offering across the stack (SaaS, IaaS, PaaS); desire for multi-cloud environments (mitigate vendor lock-in risk); Power Platform (low-code, no-code tools, robotic process automation, virtual agents and business intelligence) which makes it easier for companies to incorporate new technologies.

- Attractive valuation:

- Valuation has gotten cheaper…trading at ~3.5% FCF yield on calendar 2022. A premium to the S&P (~4.5%) and, of the mega cap tech names that we own, this is the most expensive…but supported by a high moat, strong margins, robust secular growth and the absence of antitrust scrutiny.

- Recurring revenue is >60% of total, underpins most of their valuation and is resilient and poised to be a greater part of the mix. Key to this is Commercial cloud (aggregates Azure, Office 365, the commercial portion of LinkedIn and Dynamics) which grew +35% YoY and is at >$90B annual run rate (Azure is about half of that).

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109