Current Price: $2,185 Target price: $2850

Position Size: 1.8% TTM Performance: -4%

Key Takeaways:

- Beneficiary of strong rebound in pent-up demand for travel as consumers shift spending from goods to services – Booking is primarily exposed to leisure travel which is recovering faster than business travel, aided by higher rates. Similar to Hilton, they benefit from inflationary pressures on room rates as they earn a % of room revenue.

- Room nights for the quarter were only 9% below 2019 baseline. This is a big improvement from last quarter that was still 21% below 2019. The impact from Russia/Ukraine was not quantified, but despite this, trends improved.

- Higher room rates + continued room night recovery = record bookings in April – Total dollar value of gross bookings was the highest ever for the month of April while room nights exceed the 2019 level for the first time since the onset of Covid.

- Seeing strong demand for summer holiday reservations – gross bookings for summer are now more than 15% higher than they were at this time in 2019, and within Western Europe and North America, both up over 30% vs 2019. “If the current trends continue, we could see a record summer travel season, and we’re gearing up to prepare for that across all parts of our business.”

· Connected trip, payments & alternative accommodations are long-term growth drivers – The long-term vision for them continues to be the “connected trip.” The idea is to be a platform for not just hotel, but a portal for all aspects of travel including flights, activities, restaurants (i.e. OpenTable) etc. A key part of this is building up the “supply” (e.g. tour operators). They continue to invest behind this including their payment platform (1/3 of bookings) which enables alternative forms of payment like WeChat, it enables payment to companies like tour operators through their platform, and offers buy-now-pay-later offered via partnerships with 3rd parties. This is a multi-year endeavor to transition from their accommodation only focus in the past. As these grow over time, it will drive a mix shift that will add revenue and grow profit dollars, but at a lower margin than traditional accommodations. An offsetting factor to this should be increased direct book (especially via their app), lower customer acquisition costs and lower performance marketing (i.e. lower dependence on search engines). This dynamic is key to margin growth over time as they spend close to 1/3 of revenue on marketing. Alternative accommodations are 30% of the mix and are skewed towards Europe, but they are focused on growing their US business particularly w/ building inventory w/ multi-property managers.

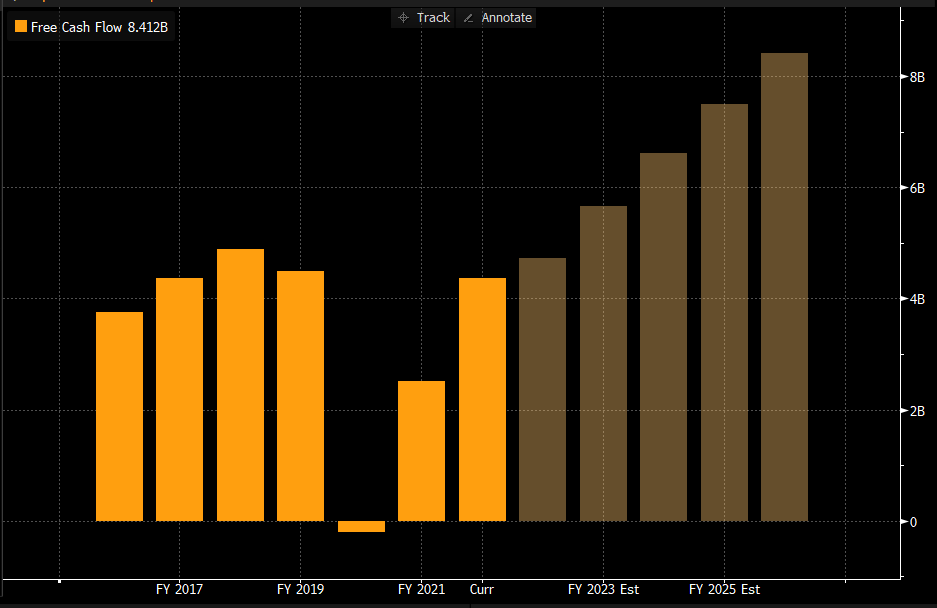

· Stock is not expensive, expectations are reasonable and supported by buybacks – Trading at ~5.5% FCF yield on 2022. Consensus is now for revenue to recover to 2019 baseline in 2022. Reinitiate return of capital to shareholders in January – outstanding authorization is just over $9 billion. They expect to complete their remaining authorization within the next three years. That means buying back over 10% of their market cap over the next 3 yrs. at current valuation.

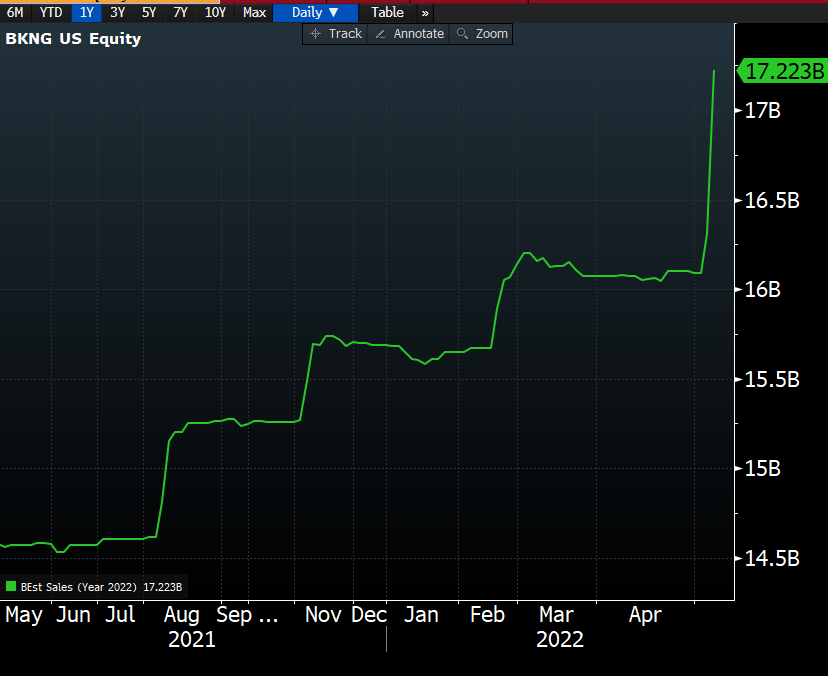

Revenue expectations for 2022 have been climbing and took another leg up after they reported…

Free cash flow is expected to recover to 2019 levels this year, and strong growth is expected to continue…

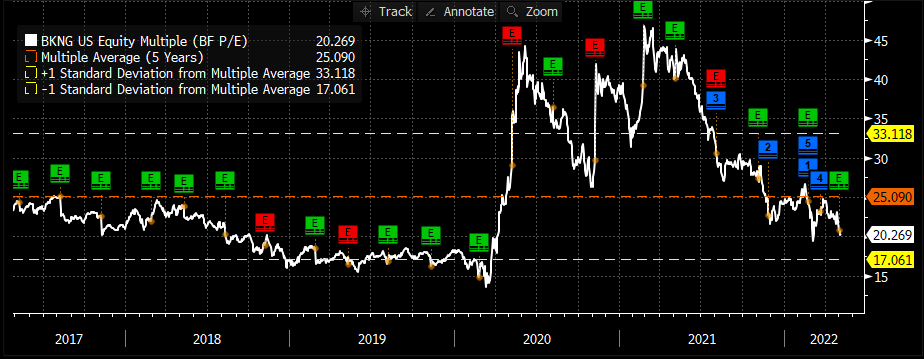

If you look at a P/E chart on the name it doesn’t give great perspective on their valuation. What looks like a higher P/E ratio in the chart below in 2020 and 2021 does not mean the stock was “expensive.” Results were impacted (earnings depressed) by Covid. And what looks like a little below average now is based on an average that is very skewed by those historical higher P/E’s during the depths of Covid…and add onto that, that current one year multiples are impacted by big forward growth expectations (e.g. 36% EPS growth expected in 2023).

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

$BKNG.US

[category earnings ]

[tag BKNG]