Good Afternoon,

I have attached the most recent “Chart Pack” put together by SSGA. I included three charts that stood out to me.

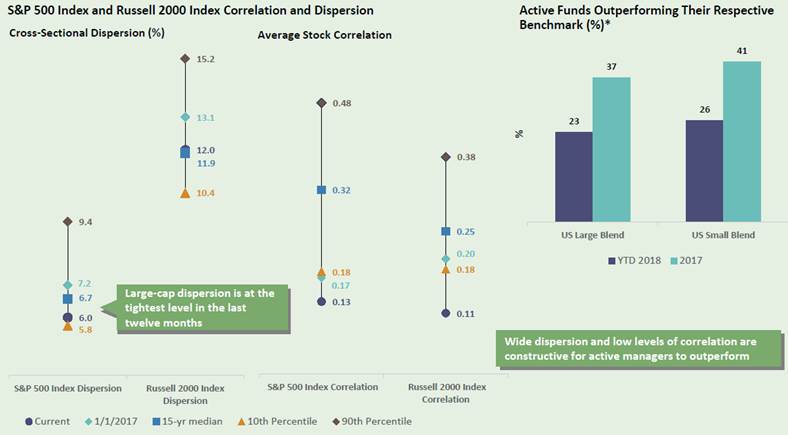

Active Managers – return dispersion contracting relative to 2017; higher correlations and less dispersion make it harder to outperform

Growth vs. Value – outperformance of growth approaching level seen in 2000 during Dotcom Bubble

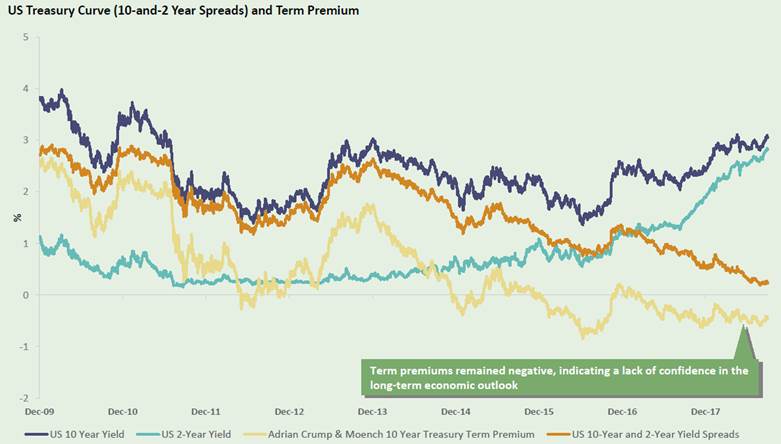

U.S. Treasury Curve – The Fed keeps lifting the short end of the curve while negative term premiums weigh on long end

Here is a link to an article from the NY Fed discussing term premiums if anybody is interested in digging a bit deeper:

http://libertystreeteconomics.newyorkfed.org/2014/05/treasury-term-premia-1961-present.html

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109