MWTIX – Q3 2018 Commentary

MetWest Total Return Bond Fund performed in line with the Agg during the quarter. Slightly longer duration was a headwind during the period, while the strategy benefited from its allocation to non-agency MBS. Given that we are nearing the end of the credit cycle, the team is generally cautious and favors more quality investments including less cyclical credit and certain asset backed sectors.

Market Overview:

– Third quarter was characterized by solid U.S. economic data across several dimensions

o Jobless claims dropped to their lowest level in 49 years while GDP growth reflected an annualized growth rate of 4.2%

– Equity market delivered a gain of 7.7% in the third quarter reaching fresh record highs

o Led by accelerated retail sales and strong corporate earnings

– Investors were also encouraged by constructive steps between the U.S. and Mexico on NAFTA re-negotiations

– Beginning signs of weakness have begun to show in the housing sectors

o New home sales, housing starts, and building permits have disappointed

o This is an interest rate sensitive part of the market and affordability is lower than it has been in the past

– Trade tensions with China are another source of concern as multiple retaliatory tariff announcements in July and September raised the ante in trade battle

– Other potential headwinds for risk assets include emerging markets volatility, highlighted in the third quarter by marked foreign exchange pressures

– Fed maintained a positive assessment of the economy and continued to hike rates

o Brings the Fed funds target range to 2.0 – 2.5% at the September FOMC meeting

– Fixed income performance was flat during the third quarter, though the Agg outpaced duration-matched Treasuries by 53 bps

o Investment grade corporate credit experienced a modest rebound after a week second quarter gaining 1% to bring year-to-date decline to 2.3%

o High yield corporates continued to benefit from a supportive technical backdrop of lighter issuance to post a 2.4% total return

o Agency MBS fell a modest 0.1% bringing negative excess returns YTD

Performance Overview:

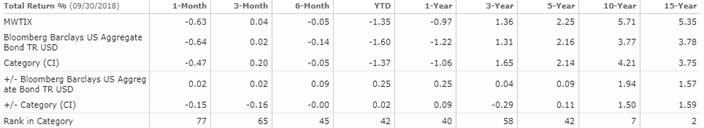

– MWTIX was roughly flat during the quarter with a net of fees return of .04% notching a 2 bps lead over the Agg

– A slightly longer duration profiles versus the Index resulted in a small drag as rates moved higher over the period

o Underweight to EM and non-US sovereign credit further weighed on relative performance as these areas of the market largely recouped losses in September

– ABS and CMBS benefitted relative performance as both sectors saw spreads tighten by more than the index over the quarter

– Allocation to non-agency MBS and the position in Japanese Government issued T-bills contributed to margin

Market Outlook:

– With leverage near record highs, issuance ever more aggressive, and low yield composition, signs that we are nearing the end of credit cycle continue to grow

o When markets are flooded with liquidity, investors have gotten away with overlooking growing weakness in underlying fundamentals

– Fiscal stimulus has bolstered headline figures of macro data and corporate earnings

– In a new liquidity-constrained environment with brewing risks under the surface, prevailing asset prices reflect a degree of misplaced optimism

– Overall positioning of the portfolio remains defensive with respect to credit

o Emphasizes high quality, non-cyclical sectors that would be resilient in face of deleveraging event

– Team continues to actively manage the fund with an eye toward attractive relative value

o Securitized products remain a focus and favors higher quality more senior issues

– Legacy non-agency MBS remain attractive, though allocations will likely edge lower as prices rise

– Agency MBS provides better liquidity characteristics and is high quality, but uncertainty remains as the Fed begins to shrink its position

– Opportunities for reasonably safe yields can still be found in the higher quality segments of ABS and CMBS though investors must remain vigilant

– Consistent with this defensive posture, the Fund’s ABS allocation favors more robust structures such as federally guaranteed student loans and AAA-rated CLOs that offer value

Performance Review:

[Mutual Fund Commentary]

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109