Current Price: $66 Price Target: $101

Position Size: 2.5% TTM Performance: -11%

Cognizant reported mixed results for 3Q18 missing on revenue, beating on earnings and lowering their full-year revenue forecast. Similar to last quarter, lower than expected revenue was on weakness in their largest end market, financial services. A lower tax rate led to EPS that was ahead of consensus, $1.19 vs $1.13. Despite a revenue miss last quarter they maintained full year revenue guidance, but had to lower it with this report. The street is ahead of the high end of the new revenue guidance range. FY EPS guidance kept at least $4.50. Street is at $4.53.

Key Takeaways:

· Their high exposure to legacy IT, financial end markets, and a growing war for talent, is leading to concerns that achieving both revenue growth and margin expansion may be difficult for them.

· Annualized attrition rate remains elevated at 22% (same as last quarter). They cite a “growing shortage of technology talent.” Growing secular trend of on-shoring is also having an impact. “As we continue to hire locally we’ll have some resources that will be a little bit more expensive than resources that we have leveraged in the past.”

· Digital revenue growing while legacy business is flat to down. Legacy is also seeing pricing pressure.

· Digital revenue is 30% of the mix and growing “in the low 20% range.” This growth rate on digital is similar to others in the industry. Over the last couple of months they announced three acquisitions to enhance their digital capabilities.

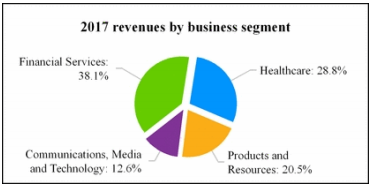

· By segment:

o Financial Services, their largest segment (38% of revenue), had the slowest growth at 2.6%. Accenture reported similar growth at 3%. Gross margins in this segment have been declining.

o Healthcare (28% of revenue) was up 9.6%.

o CMT, their smallest end market, grew 17%.

o Products and Resources segment grew 11.5%. The strongest quarter they’ve had in retail in many years as companies spend on developing omni-channel capabilities.

· They remain committed to their 22% operating margin target by 2019, but the concern is whether that may come at the expense of slower top line growth.

· They are committed to increasing returns to shareholders via buybacks and dividends and are looking to make additional tuck-in acquisitions.

Valuation:

· FCF yield of ~6%, >1% dividend yield with plenty of room to grow, strong balance sheet (no net debt, $5B in cash) and ROIC running in the mid-20’s.

· On track to complete plan announced in February 2017 to return $3.4B to shareholders by the end of 2018.

$CTSH.US

[tag CTSH]

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109