LISIX – Q3 2018 Commentary

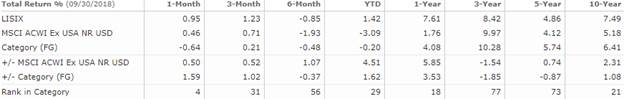

While the international developed market has struggled, Lazard International Strategic Equity was up almost 1.5% through the end of September. The team has made a strong turnaround in the past year, ranking in the top decile relative to peers during that period. Lazard believes that its focus on selecting quality, high growth stocks should help the strategy to continue outperforming.

Market Overview:

– International equities rose in the third quarter with perceived strength of the U.S. economy driving stocks higher despite a number of negative international developments

– China came under pressure as the economy slowed and trade war rhetoric picked up

– Italian stocks fell on concerns over the new government’s fiscal stance

– Emerging market currencies continued to slide

– Strong oil prices and U.S. data drove up energy shares and industrial cyclicals

o Renewed Euro concerns drove down financials and local utilities

– Automotive stocks were hurt by trade war fears and a slowdown in China, while health care was seen as enjoying uncorrelated growth

Performance Overview:

– LISIX performed in line with the MSCI EAFE Index during the quarter

– The largest positive contributor was stock selection in financials

o Dutch Bank ABN Amro and global insurance broker Aon all held up well after solid results

– European bottling company Coca-Cola European Partners and semiconductor leader Taiwan Semiconductor also reported encouraging earnings

– On the negative side, Japanese specialist construction company Daiwa House disappointed on margins

o Video game company Nexon and its key contributor Tencent were hurt by the hiatus in game approvals for Chinese regulator

o Canadian oil company Suncor fell with the local market

Market Outlook:

– On the macro side, global economy is developing somewhat of a split personality

o Data from the United States remains very strong, buoyed by corporate tax cuts and strong business confidence

o This is driving up inflationary expectations, driving down unemployment, and driving up interest rates

– The tightening of the US dollar liquidity is putting increased pressure on the rest of the world

o Traditionally vulnerable markets like Turkey have been especially hurt

– Trade war rhetoric is hurting global trade sentiment, including a

o This includes a China that was already starting to slow and Europe that is once again facing political uncertainty

– Environment is seeing money flow into U.S. equities and into companies seen as offering structural growth

o Unless China launches a major stimulus, the risk from here is that the U.S. economy stutters provoking an end to USD tightening

– Rising costs may start to pressure margins while rising rates are generically concerning given the overwhelming amount of debt that has continued to pile up on public and private sector blance sheets since the financial crisis

– Overall, the managers remain confident that by continuing to focus on stock selection the long term track record will continue

o Focus remains on stocks with sustainably high or improving returns trading at attractive valuations

Performance Review:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109