In the Q3 review for Equity Market Neutral, AQR reiterated how they look at their four investment themes, broke down performance attribution, and further discussed how to address the underperformance of value.

I summarize these three topics below, and I have attached a new one-page piece they created that provides a look at performance, market environment, and outlook.

Review of the Themes that go into selection for QMNIX:

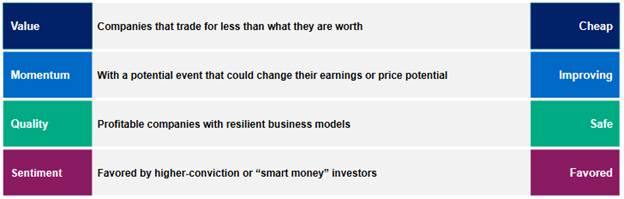

The AQR Market Neutral strategy invests based on four different themes: value, momentum, quality, and sentiment.

Four Key Investment Themes:

Value: prefer to buy companies that are cheaper than they are worth rather than more expensive

Momentum: prefer to buy companies that are moving in the right direction as opposed to trailing

Quality: prefer to buy more profitable companies with strong business models

Sentiment: prefer to buy companies that are favored by institutional type investors

Long and Short in Practice:

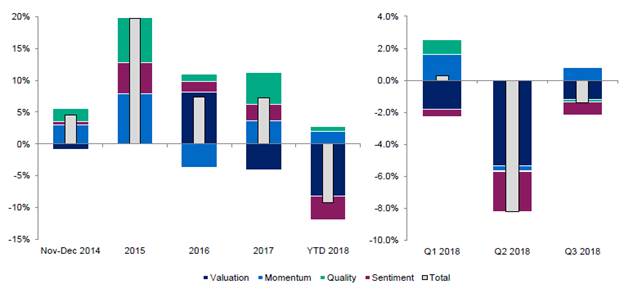

QMNIX Attribution Breakdown by Theme:

– Vast majority of the underperformance is driven by value

– It is important to note that AQR does not define momentum and growth in the exact same way. As such the “opposite” of value is not momentum, and we don’t see an exact offsetting on the positive side from the momentum theme.

– Diversification of themes has not helped so far this year but this has played a strong positive role in prior years.

Value vs. Growth:

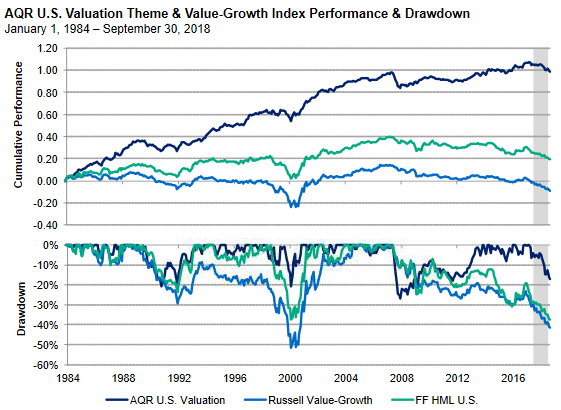

I know that we continue to harp on the value story as a main driver for underperformance and one may suggest that the Russell Value vs. Growth indices haven’t been quite as drastically different over the last two quarters as AQR may suggest.

To respond to this, AQR reminds us that their way of looking at value differs from the broad Russell indices, as AQR uses a diversified mix of metrics to measure value. Below is a comparison of returns for AQR’s value metric relative to Russell and the return comparison dating back to 1984. In other words, they believe that their way of looking at value is more effective than the broad benchmark.

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109