Good Morning – below (and attached) is a discussion about ways to invest in cannabis. Many people have already seen this but I have updated the total return charts. Broadly, we are not making any proactive recommendations on investing in this area as the asset class is very new, extremely speculative, and, for many clients can be controversial.

There is only one mutual fund investment currently available, and the product is extremely expensive and poorly diversified. There are also two different ETF options available to U.S. based investors that would be suitable investments for somebody looking to get exposure to the cannabis industry. I have also included the names of two ETFs that are available for Canadian investors. Another option would be to invest in a small basket of individual stocks, with an emphasis on the largest market cap names in the industry.

Before diving into the various investment options, below is the link to a website called New Cannabis Ventures which is a platform that discusses cannabis investing for retail clients. It also has a number of news updates related to cannabis companies as well as progression toward legalization in certain areas. I found this to be a helpful resource when looking at the following array of investments.

https://www.newcannabisventures.com/

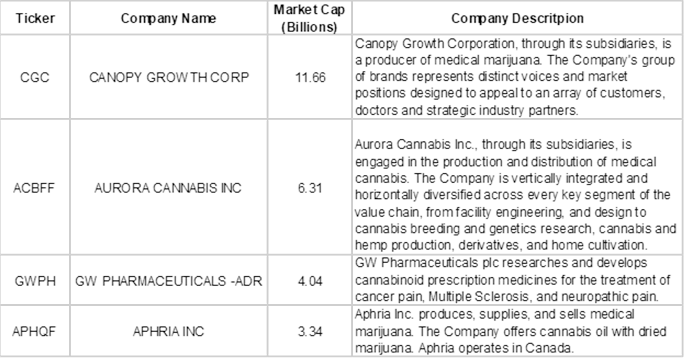

Largest Market Cap Individual Stocks:

U.S. Mutual Funds:

American Growth Fund Series II E (AMREX)

Recommendation:

– Do not buy this fund. The fee structure prohibits any possibility of alpha generation, and the fund does not appear to be truly focused on the client’s goal of cannabis investment.

Overview:

– Fund is built primarily of stocks that are, in at least some way, involved with the legal cannabis business; this includes companies of all cap sizes and potentially REITs

– The Series II Growth Fund has been around since 2011 but was reorganized into a diversified cannabis mutual fund on July 29, 2016

Fees: Net Expense Ratio of 14.53%

Performance:

Top Holdings:

United States ETFs:

ETFMG Alternative Harvest ETF (MJ)

Recommendation:

The Prime Alternative Index was created for the purpose of allowing investors to track the movements of the cannabis industry throughout the process of new legalization initiatives. However, the major drawback of this product is that it invests in industries such as tobacco and justifies these as part of the “prime cannabis ecosystem”. The fund itself is reasonably priced and the investments are fairly diversified despite the niche market in which the managers play. Finally, the fund has reached nearly $500 million in AUM and trades fairly regularly, alleviating major liquidity issues.

Overview:

– The goal of the fund is to mirror the returns of the Prime Alternative Harvest Index

– The index was created to allow investors to track both event-driven news and long-term trends in the marijuana industry as well as the industries likely to be influenced by cannabis legalization

– Designed to measure the performance of companies within the cannabis ecosystem benefitting from global medicinal and recreational cannabis legalization initiatives

– Company must operate in one of the following categories: cannabis-focused, cannabis biopharma, tobacco and tobacco substitutes, tobacco related companies, agrochemical

– First and only U.S. ETF to target the cannabis/marijuana industry

Fees: Net expense ratio of 0.75%

Performance:

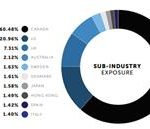

Top Holdings & Geographic Diversification:

Horizons Marijuana Life Sciences Index ETF (HMLSF)

Note: this is the U.S. over the counter version of the Canadian based HMMJ

https://www.horizonsetfs.com/hmmj

Recommendation:

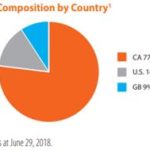

I believe this is the most broadly diversified investment option and provides the most direct exposure to the cannabis industry through an ETF vehicle. Constituents are required to have at least 50% of their business activities related to the marijuana or hemp industries. Additionally, companies within the index are required to file regular audited financial statements and meet minimum trading requirements. One issue with the fund is that it is dominated by 3-4 very large cannabis LPs in Canada. This product is reasonably priced compared to other cannabis investment options but does trade OTC. While this should not be a major concern, this does trade much less frequently than MJ, which is a U.S. listed ETF.

Overview:

– Tracks the performance of the North American Marijuana Index

– The index tracks a basket of North American publicly listed companies with significant business activities in the marijuana industry

– Companies include producers or suppliers of marijuana, biotechnology companies engaged in research and development of cannabinoids, companies that offer hydroponic supplies and equipment aimed to increase efficiency in marijuana cultivation

– Constituents are required to have at least 50% of their business activities related to the marijuana industry

Fees: Net expense ratio of 0.75%

Performance:

Top Holdings and Exposures:

Other Cannabis ETF Offerings Listed on Canadian Exchange:

Horizons Junior Marijuana Growers ETF (HMJR.TO)

– Designed to replicate performance of a basket of primarily publicly listed small cap companies in North America primarily involved in the cultivation, production, and/or distribution of marijuana

– Net assets of only approximately $15 million

Redwoods Marijuana Opportunities Fund (MJJ.TO)

– First cannabis focused ETF providing the manager the ability to use long-short strategies

– Net assets of only about $10 million

[Market Themes]

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109