Recommending we sell Aramark and add 100bps to TJX and 50bps to HLT.

Rationale for selling ARMK:

· The quality of this holding seems to be eroding – it’s one of the highest leverage ratios in our portfolio, thin margins, low ROIC, less confidence in execution, concerns of earnings quality and rising cost of capital for an acquisition driven company.

· Organic revenue growth targets 2-4%, which means almost no real growth for a company that is very exposed to rising input costs and needs to pass some through on pricing. Things like better labor productivity have aided in offsetting wage increases, but there is a limit to this.

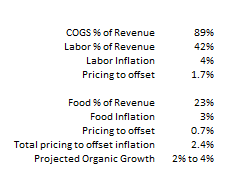

· Gross margins are about 11% and labor is their largest expense at 47% of COGS. Food is 27% of COGS. They expect 4% inflation in pricing next year and at least 3% in food. That means they need to take almost 2.5% in price to pass this through, which may be most or all of their organic growth next year. The low end of their organic growth target is only 2%. About ~30% of contracts are pass through, so they can contractually pass along inflation.

· FCF margins average 1.7% and valuation relies on FCF margins improving. However, new contract growth has a profitability lag because they require up-front costs that weigh on margins. This will be a drag on FCF.

o They capitalize up-front cash payments for renovations of client facilities. This hits the capex line and is in “other assets” on the balance sheet (net of accumulated amortization it’s around $1B). The up-front money they are spending on build-outs and renovations are key to them winning contracts – Aramark is essentially financing these assets (restaurant build-out and equipment) for their customers, but the “cost” to the customer is in Aramark’s margin. So Aramark gets a higher margin, a more bloated balance sheet (and lower ROIC) and the customer often owns the equipment at the end…which is usually a key test of whether it’s an operating lease or a capital lease. So part of their competitive advantage vs smaller players in this fragmented market is that they can lend use of their balance sheet.

o They have a spotty track record with accruals and expect net income to outpace FCF for the foreseeable future – their capex has been outpacing depreciation for the last few years – a good reason to look at their FCF margins instead…which are razor thin and requires lending out their balance sheet.

· Stock based comp is resulting in share dilution which they expect to be about 1% per year.

· The opportunity with this name and the thesis is about consolidating a fragmented industry…which does seem to be a big opportunity, but they haven’t been executing as well as hoped. While they benefit from scale, some of their technology initiatives they talked about in their investor day highlight a difficulty with their model: complexity. They try to manage wage inflation through improved labor scheduling because when they don’t, they have excess overtime and use of (higher cost) agency labor. They’ve acquired different technologies to help them manage this and help manage rising food costs. They do benefit from scale in purchasing power, but they also seem to suffer from it a little as well in the sense that this is an extraordinarily low margin business and they need to manage a gazillion employees and varied ingredient costs. The magic in restaurant chains can be that they keep stamping out the same box over and over again. Same menu, same labor model, consistent four wall margins. For Aramark, each “box” is more built to suit. Menus can be unique, labor requirements vary. In an environment of rising input costs it can make things very difficult.

$HLT.US

$ARMK.US

$TJX.US

[category Research Trade]

[tag AAPL]

[tag ARMK]

[tag HLT]

[tag TJX]

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109