Key Takeaways:

Current Price: $197.6 Price Target: $215

Position Size: 2.37% 1-year Performance: -24%

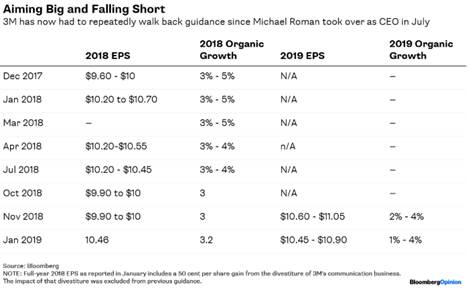

MMM released its 4Q18 earnings results this morning, with organic growth standing at 3%, and EPS up 10% y/y. Latam/Canada had the strongest growth at +5%, followed by the US +4.4%. No business stood out as outperforming or struggling this quarter but 3M cited weak customer demand for its auto and electronics business in China having dampened revenue in 4Q18. On the positive side, the company lowered its estimate of the Trade impact on earnings from $100M to $70M. Overall tariffs and raw materials costs impact should be lower in 2019 than in 2018. The current CEO has been cutting forecasts pretty consistently since he took over as CEO in July 2018. Looks like he needs to manage expectations a bit better!

Segments results:

Industrial: +2.5% organic growth (growth in all sub-segments), operating margins +160bps

Safety & graphics: +3.3% organic growth with Scott Safety up double-digits but transportation and roofing granules had growth decline, operating margins -390bps y/y

Healthcare: +4.8% organic growth (only decline was in drug delivery business), operating margin -80 bps y/y due to further investment in aligners business

Electronics & energy: +4.1% organic growth, operating margins +350bps y/y

Consumer: +1.9% organic sales (growth in home improvement and office supplies, decline in home care & consumer health), operating margins -110bps y/y

2019 guidance:

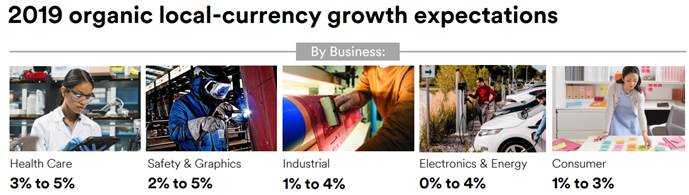

· Organic growth 1-4% vs 2-4% before. Pricing will offset raw materials inflation.

· Adjusted EPS lowered by 1.4% due to the impact of a recent acquisition (healthcare focused AI tech business of M*Modal) and softer organic growth. GAAP EPS target $10.45-10.90

· ROIC 22-25%

· FCF conversion 95-105%

· Share repurchases to help EPS by $0.25-0.30 per share

Thesis on MMM:

• Strong brand name, history of successful innovation, scale and low cost advantage help to drive above average returns.

• International expansion and pipeline investment should drive mid-single digit top line and high single digit bottom line growth. Emerging markets represent 47% of sales today and should reach 50% by 2020.

• The company is in good financial position and has a strong history of share buybacks, dividends and acting in the best interest of the shareholder.

• Quality management team with a decent incentive structure.

[tag MMM] $MMM.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109