MWTIX – Q4 2018 Commentary

The MetWest Total Return Bond fund slightly lagged the Agg during the fourth quarter but outpaced the benchmark for the year. The strategy had strong relative performance for the year due to its investment grade credit positioning and exposure to Non-agency MBS. MetWest maintains a defensive positioning with non-cyclical credits, high quality securitized exposure, highly liquid Agency MBS, and a duration in line with the benchmark.

Market Overview:

– Harsh financial winter took place in the fourth quarter as investment markets were whipsawed by investor concerns regarding slowing global growth, trade deterioration, and policy uncertainty

o Volatility registered a sustained gain, closing above 30 for four days

o This dampened mood of investors that faced a liquidity constrained end to the year

– The FOMC raised rates for the ninth time in December bringing the target rate to 2.5%

o While this was broadly expected, it led many investors to expect the Fed to pause rate hikes in 2019 even as the Fed maintained a tightening bias

– The Fed did adjust its growth outlook downward, coinciding with softer manufacturing and housing market data

– The Treasury yield curve has flattened considerably as inflation expectations compressed

o Curve actually inverted between the 2 and 5 year maturities in mid-December

– Investors began to price in the effects of higher short-term rates and flatter yield curve towards the end of 2018

o During the selloff equities were the hardest hit, bond markets posted positive returns as rates fell, high yield sold off along with investment grade corporates

– The general theme among credit for the fourth quarter was one of lower quality underperformance

o Non-agency MBS struggled in the fourth quarter alongside the broader market, posting their first negative months of returns since February 2016

Performance Overview:

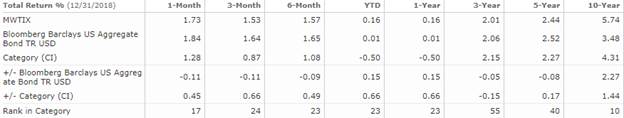

– MWTIX gained 16 bps for the year, outpacing the Agg

– As rates marched higher until early November 2018, the duration of the fund was extended in a disciplined fashion

o The team dollar cost averaged the position from 0.3 years short the index as the start of the year to 0.2 years long at the end of the year

– Holdings continued to favor regulated sectors like senior financials and utility credits and defensive credits like industrials and consumer non-cyclicals

– With the selloff in the fourth quarter vulnerabilities were exposed as weakening flows and tight liquidity conditions proved challenging for broad swaths of the market

– The team believes this climate will continue to confront assets

o Global monetary policy less accommodative in the coming year, coinciding with a general expectation for deceleration of growth across most major economies

Market Outlook:

– For the U.S., it is possible that the Fed will be forced to pause its rate hikes

o Even with the fourth quarter’s spread widening and recalibration of investor sentiment, the team does not believe that valuations have fully priced in longer term risks

o Believe it makes sense to position for volatility now

– Duration in the fund was reduced to 0.1 ahead of the benchmark to start 2019

– Overall sector positioning remains defensive, with corporate credit emphasizing regulated financials and defensive sectors

– Outside of corporates, securitized products exposure remains on agency-backed issues

o Exposure was trimmed somewhat in favor of better opportunities

– Non-agency CMBS allocation continues to emphasize seasoned issues at the top of the capital structure

– Fund continues to hold fully currency-hedged Japanese T-bills as a higher yielding cash substitute though position has drifted lower as better opportunities have emerged

Performance Review:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109