WATFX – Q4 2018 Commentary

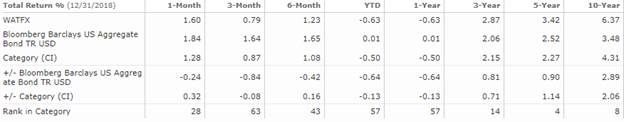

Western Asset Core Bond underperformed during the fourth quarter and lagged the benchmark slightly for the year. The largest relative detractor was the exposure to investment grade credit. Following a period of increased volatility, the team has repositioned the portfolio to take advantage of more attractive pricing across certain sectors.

Market Overview:

– U.S. Treasuries generated a positive return during the fourth quarter

o Most spread sectors posted negative results amid a flight to quality over the last three months of the year

– This was triggered by concerns over the impact of continued monetary policy tightening, trade war rhetoric, signs of moderating global growth and geopolitical issues

– Q3 2018 GDP growth was 3.5% relative to 4.2% growth in the second quarter

o Deceleration of growth reflected a slowdown in exports and decelerations in nonresidential fixed investments and personal consumption

– The labor market remained tight during the fourth quarter

o Unemployment rate was unchanged at 3.7% in October and November

– Unemployment rate ticked up by year end, driven by an increase in workforce participation rate

– Manufacturing sector continued to expand but pace moderated during the fourth quarter

o PMI expanded for the 28th consecutive month in December and 11 of 18 industries measured by the PMI expanded in December

– The Fed raised rates at its meeting in December by 25 bps increasing target to 2.5%

o This was the ninth increase since 2015 and Fed currently anticipates raising 1-2 more hikes in 2019

– Both short and long term Treasury yields declined during the fourth quarter

o When period began 10-year yield was 2.81% and it ended the quarter at 2.48%

o It rose as high as 2.98% on November 8th

Performance Overview:

– WATFX had a positive return during the quarter but lagged the benchmark

– An allocation to investment grade corporate bonds was the largest detractor to performance as spreads widened

– Yield curve positioning detracted from results as the curve steppened during the quarter

– Allocations to agency and non-agency MBS were headwinds as well as their spreads generally widened

– Having a long duration was beneficial as rates moved lower across the curve

– A number of adjustments were made to the portfolio during the quarter

o Trimmed portfolio duration as yields declined

o Reduced some exposure to the front end of the yield curve as the market is close to pricing out additional Fed rate hikes

o Modestly increased corporate credit exposure as spreads moved wider

o Pared structured product allocation as spreads became relatively tight in certain subsectors

Market Outlook:

– Synchronized growth expectations in 2018 were dashed rather quickly

– They believe that the U.S. has gone from strength to strength while global economies have gone from weakness to weakness

– While global growth is softer and multiple tail risks seem to be in play, the team believes that a lot can still go right

o Tightening of monetary policy in the U.S. contrasted with reintroduction of stimulus in China bode well for synchronized global growth

– Fed Chair Powell started the year by upwardly revising its expected path of Fed policy rates based on greater fiscal thrust and stronger global growth

– Fed policy should tighten as inflation rises but an understanding by the Fed that models are not always exactly correct gives investors confidence

– December remarks by the Fed indicated that a forecast for continued growth was appropriate

o There was a negative market reaction to a Fed which now appeared less dovish than anticipated, as risk market sold off dramatically

– In early January, Powell stepped back his previously optimistic tone saying that there is no pre-set path to pushing its benchmark rate higher

– The overarching principle of policymakers since the financial crisis has been to maintain the global recovery

o It is clear that continued assistance remains necessary

o In Europe and Japan, monetary stimulus remains in force

o China is now moving to increase policy stimulus

Performance Review:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109