HILIX – Q4 2018 Commentary

The Hartford International Value Fund underperformed its benchmark during the fourth quarter and for the full year. The team began to defensively position the portfolio but was not positioned well enough toward year end. Given the recent sell off in the market, the team sees buying opportunities as they focus on companies with low valuations, low relative price, and low expectations.

Market Overview:

– Non-U.S. equities tumbled ending the fourth quarter down 11.70%

o Concerns about slowing global growth weighed heavily on the markets

– China’s economy grew at a slowest pace in a decade

o Economic growth in Eurozone also slowed sharply

– Markets contended with a myriad of risks including increased geopolitical tensions, trade uncertainty and tighter liquidity, all of which contributed to higher downside volatility

– Fed raised rates by 25 bps to the highest level in a decade

– ECB concluded its asset purchase program but announced that it would continue its reinvestment policy for an extended period

– China reduced the reserve requirement ratio for banks by 1% in an effort to spur growth

Performance Overview:

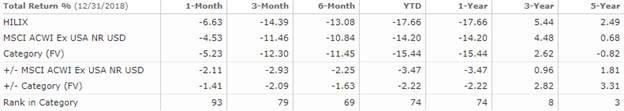

– The Hartford International Value Fund returned -14.42% in the fourth quarter of 2018

o It underperformed the benchmark during the period despite a modest style tailwind

– The portfolio was not positioned defensively enough during the recent downturn

o Had been adding to defensive-value areas such as telecoms

– Stock selection was weak across holdings in financials, consumer discretionary, and industrials

o Many cyclical oriented stocks took a beating

– This was partially offset by strength amongst holdings in materials

– Sector allocation detracted from relative performance during the period as well

o Primarily driven by overweight to energy, which lagged as oil prices fell

o Underweights to healthcare and real estate proved more defensive

– Japanese names lagged the most while EM names performed best

– Top detractors included Saipem and T&D Holdings

– Top contributors included COPEL, Gold Fields Limited, and Barrick Gold Corp

Market Outlook:

– The team continues to focus on opportunities which fit into framework of looking for stocks with low relative price

o Look for low expectations, low valuations that generally feature strong balance sheets and significant potential upside

– The team initiated positions in three real estate companies as valuations became more favorable

– Eliminated a few positions from the fund including Zurich Insurance Group and Pioneer Corporation

– The team continues to buy pessimism in the market and believes there are buying opportunities created by the recent selloff

o Recently purchased a German-based global airline that fit its investment criteria and continues to be disliked by sell side ratings

Performance Review:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109