Key Takeaways:

Current Price: $64.88 Price Target: $90

Position Size: 2.11% 1-year Performance: -1%

While CVS reported 4Q18 earnings that beat market expectations, its continued struggle within its long-term care business and lower than expected 2019 guidance is pressuring the stock today. The bright spot was the continued growth in filled prescriptions (+7.4% pharma same-store-sales), proving that the online threat is not impacting store sales. Retail/Long-Term Care (LTC) operating margin was down 130bps in the quarter on greater investments in the business and the LTC weakness. [more]

PBM claims were up +5.7%, and although purchasing economics improved, pricing pressure continued. The client retention rate remains high at 98% but excludes the Centene upcoming loss. The MinuteClinic sales grew +9.8% y/y, a good testament of the value of this service within the stores.

This was the company’s first quarter including Aetna. CVS created a new health-care-benefits segment equivalent to the former Aetna health-care segment, which includes insured and self-insured medical, pharmacy, dental and behavioral health products and services.

There are a few negative points to highlight:

· The 2015 Omnicare acquisition (long-term care business) was the biggest deal CVS did until the Aetna merger. Years later CVS hasn’t been able to fix this business, triggering some questioning regarding CVS’s ability to integrate successfully another unit. Instead of being the growth driver its was advertised to be in 2015, Omnicare is facing industry challenges such as nursing homes bankruptcy, declining occupancy rates and payment pressures. “The LTC business has continued to experience industrywide challenges that have impacted our ability to grow the business at the rate that was originally estimated when the Company acquired Omnicare, Inc. in 2015,” CVS said. Almost half of what the company paid for Omnicare has been written down so far. Right now the bull thesis on the stock lies on the ability for CVS to integrate Aetna successfully, and the Omnicare failure is definitely creating some doubts in investors’ minds. We think the management team needs to bring more clarity to their strategy going forward and gain back investors’ confidence.

· CVS sees 2019 as (yet another) year of transition:

o Aetna integration. While we should see $300-350M of expected synergies, the savings will be fully reinvested, offsetting any incremental margin expansion from the acquisition

o Retail/LTC segment will be down 10% in 2019:

§ Half of the weakness is coming from the LTC business struggles & lapping of the tax reform investment

§ Half of the weakness is coming from continued reimbursement pressure and a declining generics benefit

· The corporate tax rate drop from 35% to 21% did not all fall to the bottom line as CVS reinvested some in higher wages and benefits.

To be fair, we found their action plan for 2019 attractive (more details to come in June), such as:

· New product lines in health & beauty

· Expanding higher margins service offerings

· A new PBM “guaranteed net cost” model offers greater simplicity to healthcare partners, which CVS expects to see more widely adopted in 2020 (not much traction seen in 2019). Rebates are 100% passed on to the client

· A new cost reduction effort for the combined companies (this is in addition to the $750M synergy target)

· Applying new technologies to improve health (collaboration with Apple)

· Programs to prevent hospital readmissions: by cutting them in half for example, CVS would reduce expenses by $300M.

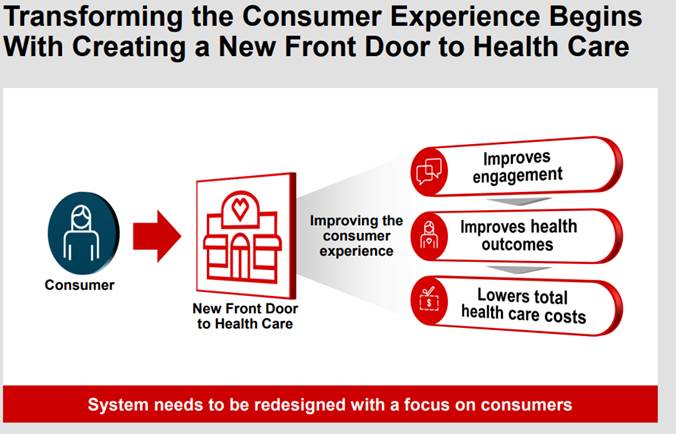

Overall we still think CVS has the right long-term strategy by becoming vertically integrated, however the recent acknowledgement of the failure to turn around Omnicare is putting a dent in the trust we have with CVS. We expect the next investor day in June to be very relevant in gaining back some lost confidence.

Thesis on CVS

- Market leader: largest pharmacy benefit manager (PBM) in the US. This gives CVS scale advantage and negotiating power with pharma companies to obtain better drug pricing discounts. Also the largest US pharmacy retailer, giving it more touch points with consumers/patients. Finally, market share leader in long-term care pharmacy sector thanks to its Omnicare acquisition.

- Stable and predictable top line and margin profile. CVS benefits from an ageing population in increasing needs of prescription drugs.

- shareholder friendly, offering a 7% shareholder yield (5% share repurchase + 2.6% dividend yield)

$CVS.US

[tag CVS]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109