Key takeaways:

Current price: $126 Price target: $139 NEW ($123 OLD)

Position size: 2.30% 1-year performance: +15%

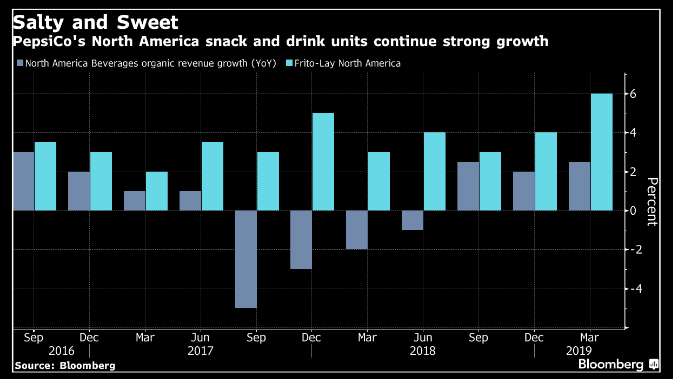

Pepsi reported +5.2% of organic revenue growth, helped by an “extraordinary” Super Bowl season. Core EPS increased 3% y/y ex-FX. Its snacks and soda segments had good sales growth, and the CFO noted an improvement in their competitiveness. However volume expansion did not last for its North America beverages segment (price increases drove the sales up), and overall growth will slow during the rest of the year. We should not expect operating margins to expand throughout the year either, as the company pursues investments to streamline its operations, combined with higher raw material costs. On the positive side, Pepsi reiterated its 2019 guidance. Overall this was a good quarter for the company.

Laguarta, Pepsi’s new CEO, continues leading new changes at the company, such as:

· Adding a new Chief Commercial Officer

· Adding new truck drivers in NA to deliver more drinks and snacks to the market

· Expansion of a cost-cutting program

Segments growth review:

· Frito-Lay North America organic growth +6%

· Quaker Foods North America organic growth -1%

· Pepsi Beverages North America organic growth +2.5%

· Latin America organic growth +10%

· Europe Sub-Saharan Africa organic growth +8%

· Asia, Middle East and North Africa organic growth +10%

Valuation: we are updating our price target to $139

[tag PEP]

$PEP.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109